Edge Case Decisions

Listen on Apple Podcasts, Spotify, Overcast

-

Description text goYou’re making too many business decisions based on edge cases. Mark Brooks explains why you should be wary of loud voices, your own assumptions, buddy bias, and single bad actors that could lead you to set poor policies, products, or prices.

LINKS & MENTIONS FROM THIS EPISODE

Sign up for our weekly newsletter for operators, Permanent Playbook: https://www.permanentequity.com/newsletters

Connect with Mark on twitter https://twitter.com/markbrooks

Connect with Mark on LinkedIn https://www.linkedin.com/in/markbrooks1/

Connect with David on twitter https://twitter.com/DavidACover

Connect with David on LinkedIn https://www.linkedin.com/in/david-cover-318752230/

Visit https://www.permanentequity.com/ for more

TIMESTAMPS

0:00 Intro

0:38 Threadboi Reads His Tweets

2:25 Making Assumptions About Pricing

4:02 Be Aware of Buddy Bias

4:47 Why We Can’t Have Nice Things

6:08 (Not) Taking Criticism

8:10 Subscribe to the Permanent Playbook Newsletter

8:35 Legal Disclaimer

EPISODE CREDITS

Produced by David Cover

Intro music by David Cover, Andy Freeman, & Wes White

Outro music by Daniele Musto

WE STEWARD COMPANIES THAT CARE WHAT HAPPENS NEXT

Visit https://www.permanentequity.com/ for more

Sign up for our weekly newsletter for operators, Permanent Playbook: https://www.permanentequity.com/newsletters

Sign up for a new daily newsletter from our very own Tim Hanson, Unqualified Opinions: https://www.permanentequity.com/unqualified-opinions

Check out our other podcast episodes here: hhttps://pod.link/1480383949

LEGAL DISCLAIMER

This podcast is made available solely for educational purposes, and the information presented here does not constitute investment, legal, tax or other professional advice, and should not be construed as an offering of advisory services, or as a solicitation to buy, an offer to sell, or a recommendation of any securities or other financial instruments. The thoughts and opinions expressed by or through this podcast are those of the individual guests and speakers and do not necessarily reflect the views of Permanent Equity. The discussion on this podcast of any entity, product or service does not imply an endorsement thereof, and the guests may have a financial interest, whether through investment or otherwise, in one or more of any such entities, products or services. This podcast is presented by Permanent Equity and may not be copied, reproduced, republished or posted, in any form, without its express written consent.es here

“You’re making too many business decisions based on edge cases.”

It’s a bold statement – after all, discounting edge cases and outliers might mean missing nuance or specificity or options for meaningful innovation.

But in his Twitter thread and Permanent Podcast conversation, Mark Brooks clarifies that the point isn’t to discount edge cases in favor of some lumpy, beige average, but instead to be wary of loud voices, assumptions you’re bringing to the table, and single bad actors. While you want to pay attention to these factors, you want to do it in such a way that you’re using that edge information to make better decisions, not letting it drive you into bad decisions.

Here are five examples of how an over-reliance on edge cases can lead to suboptimal decisions:

(1) Pricing

If you’re hesitating to raise prices because of loud voices in your client base or assumptions about how your customers are going to react to a price increase, you’re probably not basing your decision-making on what’s genuinely best for or needed by your business. Yes, there is a possibility that you could raise prices and lose customers (and you certainly need to be mindful of whether your gross margin is coming from one or two customers). But too often we see businesses that have their margins compressed – sometimes to an unsustainable degree – by an unwillingness to raise prices even to cover increases in costs. Part of doing business is understanding that costs need to get passed on.

The preventative for basing your pricing decisions on assumptions about customer reactions is to maintain good, communicative relationships with your customers. The more they understand that you’re an honest operator, the more they know that you raise your prices only when you need to, not to gouge them.

(2) Features

If the loudest voices or your closest friends are the only ones asking for a feature, consider whether it actually makes sense to allocate resources to building it. As with price increases, if a given customer represents a large enough proportion of your margins, it may be necessary to base your decisions on that one case. But a loud voice can also be just that – and you can quickly get upside down by building a product or service feature based on individual requests rather than financial imperatives.

(3) Team Policies

There’s always going to be the one person who does the one thing. And you have to decide if you’re going to address the situation individually or if you’re going to make a policy around it. If you’re going to make a policy, be sure that it’s discouraging bad actions rather than limiting high performers.

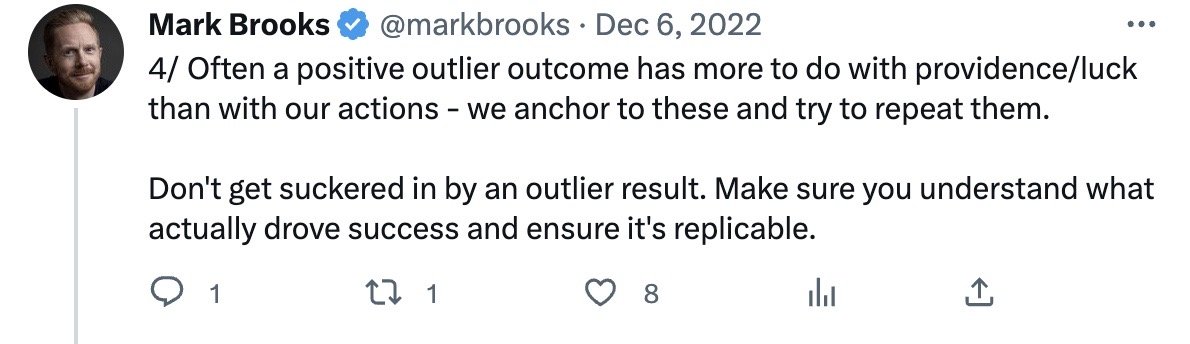

(4) Luck

In an ideal world, all good decisions would lead to good outcomes, bad decisions would lead to bad outcomes, and the feedback loop would roll along without any glitches or distortion. But luck, providence, and unforeseen circumstances can turn things on their heads. It’s worth being cognizant of what’s causally linked and repeatable and what was an outlier.

(5) Feedback

You’ve got 90 5-star reviews from people who love your product and have glowing feedback about it and a lone 1-star review from someone who thinks your product is trash. Which do you pay attention to? If you’re focused on the 1-star review, that’s a completely human reaction. But you can’t allow that one data point to drive your decision-making moving forward when the preponderance of feedback is positive. Fixating on the negative at the expense of the positive will cut good processes and products off at the knees and hamstring future creativity. Step back and look at feedback from the standpoint of the actual data.

A few notes in closing: First, proximity makes a difference in our decision-making. Sometimes the loudest voice is loudest because it’s coming from someone standing close to you. We all need trusted advisors and friends, but we also need to be able to weigh that advice appropriately when making a final call.

Second, if a business is only attuned to the loudest (or closest) voices or makes faulty assumptions based on what they think customers will want or gears all rules and regulations to the worst actor (we’re looking at you, lunch stealer), Gresham’s Law will take over. Then those voices, assumptions, and actions that are actually on the edge of reality will dominate decision-making – frequently to the detriment of your business.