The Kingdom or the Crown: Addressing the Owner Dependence Dilemma in Your Company

Owners are a particular breed. It takes grit, determination, passion, and robust amounts of optimism to start a small business. And that’s before we even get to making it succeed.

And then, if by some miracle or sheer resilience you find yourself the owner of a successful business, one that you built from the ground up, it’s hard to let go. For some, it’s a question of ego, sure – it’s hard to see the crown on a new head. But really, it’s more nuanced than that. If you start a business with the long term in mind, you also know that there will be a time that the business must be able to run without you, whether you retire, lose interest, or get hit by a bus. We love optimism, but try to keep at least a toenail on the ground.

A quick Google search will lead you to countless articles enumerating the 7 (12, 14, 57) powerful characteristics that make a successful business owner: driven, goal-oriented, confident, passionate, budget-minded, self-reliant, tenacious…

These are true, and a key part of the reason we love working with small business owners. Taken to extremes, though, and pursued without self-awareness or humility, they can set real limits on the boundaries of a company’s growth. Chances are you know an owner who might generously be called “driven,” but more realistically be described as “obsessive” or one who’s called “budget-conscious” in public and “cheap” behind closed doors. The self-reliance necessary to start a good company can easily turn into self-importance or, alternatively, distrust of outsiders.

To be clear, these are extreme cases.

That said, it’s easy to see how the very qualities that got you where you are could keep you from where you’re going, whether that’s growing your company, selling your company, or preparing for the unexpected.

The reality is that if your business is dependent on you, it’s less attractive to investors, harder to transition to new ownership, and unnecessarily chaotic to wrangle if something happens to you.

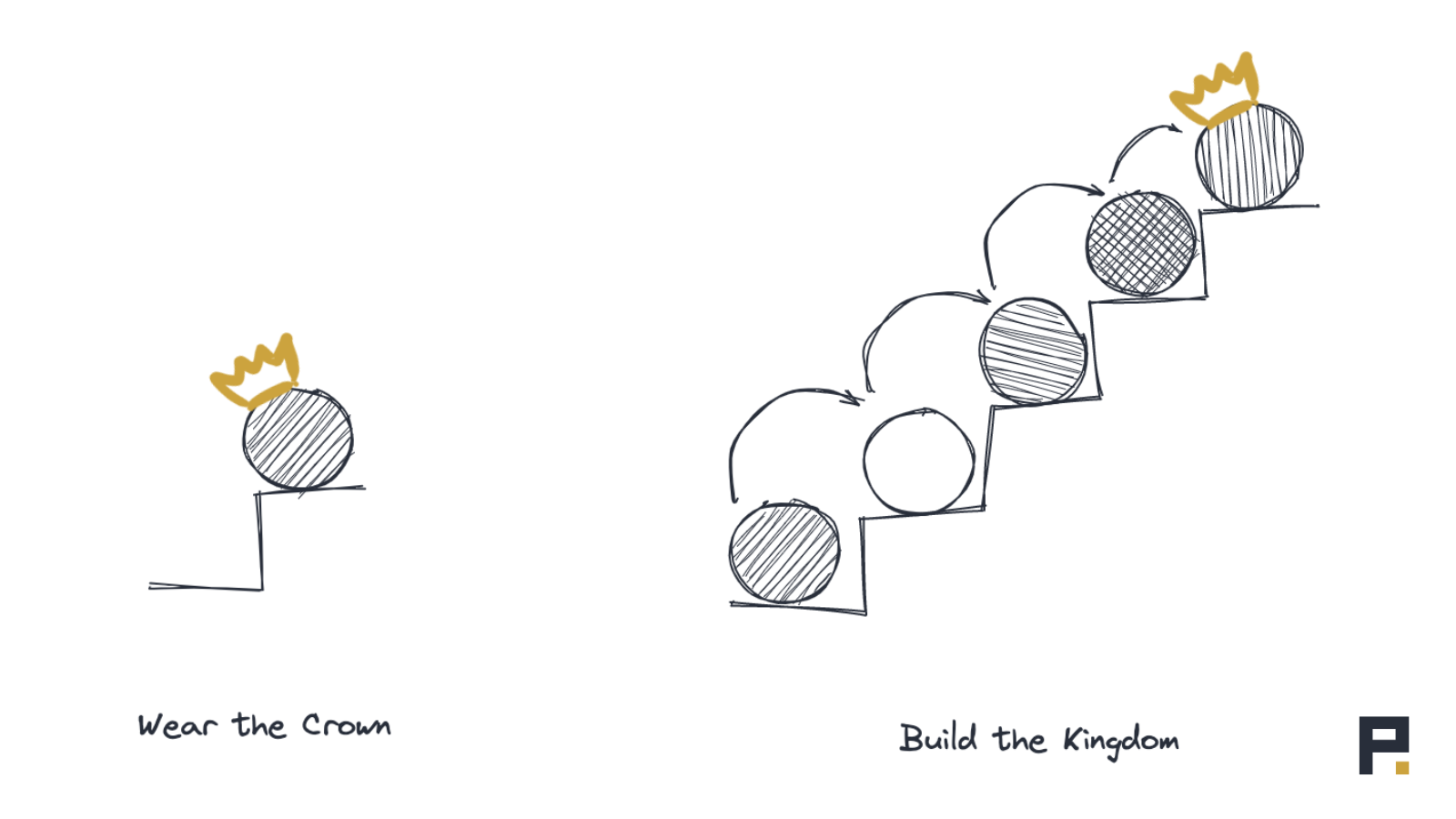

The Kingdom or the Crown

When you’re thinking about whether, how, and when to grant authority to other stakeholders and attract more resources to your business, there are real tradeoffs that you must consider. They fall into three primary buckets: Control vs. Growth, Control vs. Strategy, and Control vs. Valuation and Transferability.

Control vs. Growth

While we’re most interested in how owner control affects the eventual sale and transfer of a business, it’s worth noting that, even if you have no intention to sell in the short or even medium term, maintaining a death grip on your business as you try to scale will undercut progress and stunt growth.

In The Founder’s Dilemmas, this is the dilemma – those dueling drives to maintain a grip on the steering wheel of the organization you’ve built and to create real financial value. As Noam Wasserman writes:

“When founders must choose over and over again between profiting from their hard work and keeping control of their own creation, the best way for them to know what to do is to know their own motivations – why are they there in the first place?”

Sometimes, for periods of time, wealth creation/growth and control can be aligned. But that stage is fleeting, and, eventually, you have to pick a lane.

Control vs. Strategy

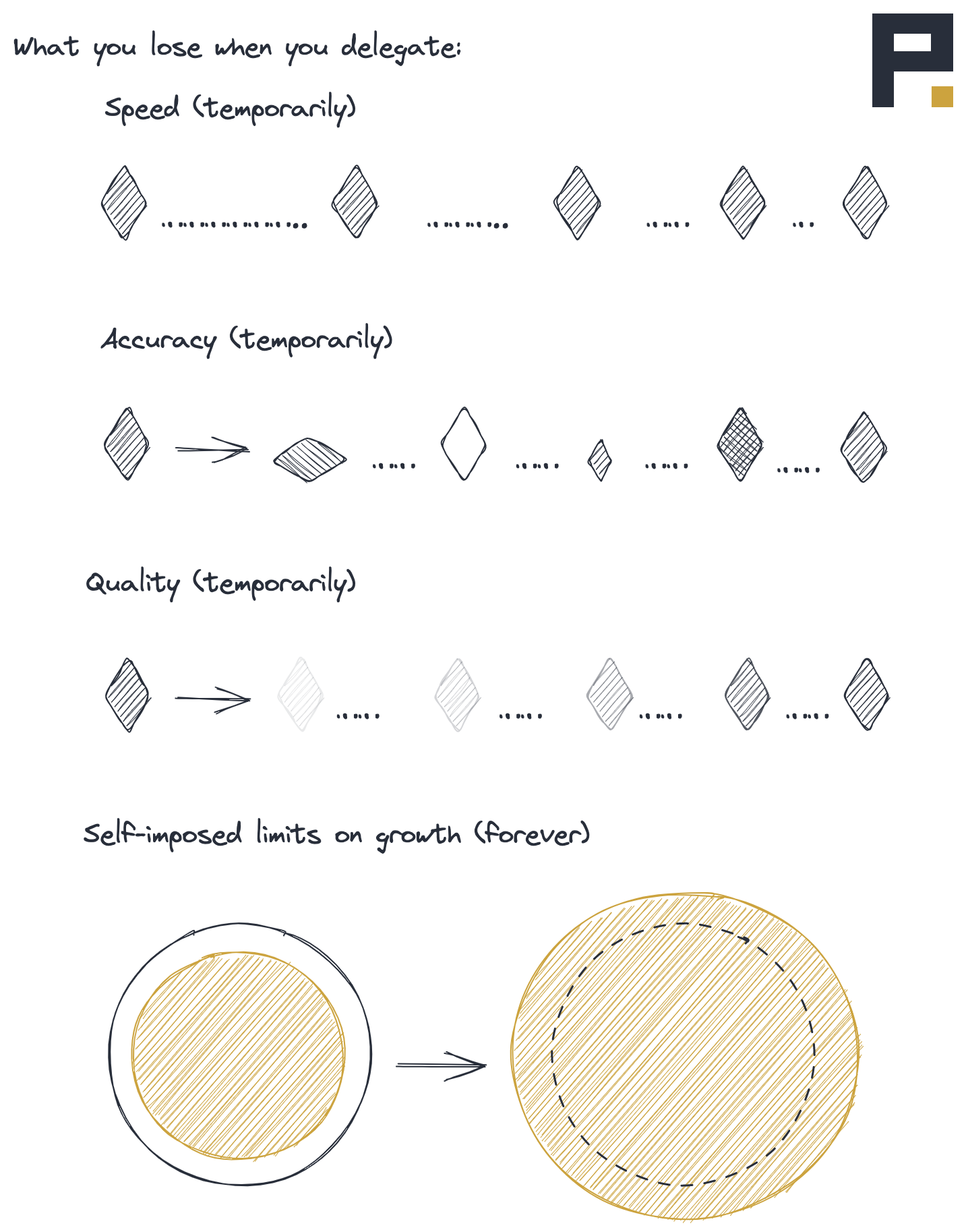

In terms of decision-making, micromanaging the day-to-day operations of your business costs you the ability to think and act strategically. It’s a bit of a paradox, but for most owners, controlling every decision from the budget for capital improvement projects to the paint color on the office walls is actually the easy way out. Hiring good people, taking the time to train them effectively, and giving them real autonomy and authority is hard, time-consuming, and doesn’t necessarily pay off until months or even years down the line.

This is particularly visible in hiring, where we’ve seen many owners who are hanging onto control because they’ve been burned by delegation before. A less qualified individual, fraud, slower pace of production…there are any number of poor experiences that might start a feedback loop validating an owner’s belief that there’s no one out there who can do the job. Particularly not when even a strategically good hire still requires training, ramp up time, and an additional salary.

Control vs. Valuation and Transferability

Here’s the real rub. When you reach a point where you’re ready to sell your business, transfer leadership, or attract real outside resources, buyers and investors have very little confidence in businesses that are reliant on one person. Great businesses can be untransferable. If you’re the sole keeper of the business’s reputation, key customer relationships, or institutional knowledge, your business is worth less to someone who is not you.

You’ll think and act for the long-term if you’re interested in financial gain. Research shows that, in small and medium-sized businesses, when there’s an opportunity to release some of your individual control, you should do it. In fact, on average, each additional degree of founder control reduces the value of the company by 23.0%-58.1%. That’s a big range, but even the low end is significant.

The kingdom/crown dilemma is just that – a dilemma. One way of holding the balance is to run your business like you’re going to own it until the end days, but be ready to sell at any time. If you can make that work, great (and let us know how you do it). For most people, though, the reality is that it’s easier to sell if you’ve built with the aim of making yourself individually unnecessary to the business.

How Owner-Reliant Is Your Company?

Your company might be owner-reliant if you hold all key customer relationships, haven’t delegated the most important roles and responsibilities, don’t have a real replacement or exit plan…

These are pretty clear indicators that you’re going to want to loosen your grip. As in all things, though, there's a gray area between contributing a vision and putting blinders on the organization. Consider these questions:

To what degree do customers buy from you individually or from the company?

When a customer or supplier is confused or dissatisfied, at what stage do you get a call?

What do you check on daily? What would happen if you didn’t?

Are processes well documented for all team members? What requires your involvement (initiation, review, approval, quality control)?

Who and what drive product/service development?

Do senior managers have the authority and autonomy to make key decisions on their own? What do they know they have to come talk to you about?

Is there someone in-house that you’ve identified as a good fit to take the reins? If not, why?

Can you identify someone from outside the organization who would have the right attitude, aptitude, and skills to take over from you?

What is your average work week in terms of hours? How much of that time is spent on review? Approval? Fieldwork? Innovation?

What types of internal disputes or conflicts are resolved by you personally?

How often do you personally negotiate business decisions (e.g., technology or facilities investments, compensation plans, etc.)?

If a supplier or vendor comes to your company about a price raise, what’s your role?

Does the company culture stem specifically from your personal values? How would it differ if you weren’t there?

Being indispensable can feel good, and it can show up in a lot of different ways – from levels of decision-making to tactical implementation.

How to Scale Back and Scale Up

The point is, command and control only takes you so far and opens so many doors for you – and your company and team. If you want to build real wealth, transferable value, and a business that continues without you, the greatest thing you can do is make yourself unnecessary.

That’s a hard thing to do, both in mindset and in practice. How do you confidently build a business that is not too dependent on you, while still allowing you to add value as the owner/visionary? How can you, as the leader of a small business, confidently hire/delegate without risking not only the business but your income stream?

Know yourself, and create priorities. Figure out what you’re exceptionally good at. Everything else should fall off your plate as soon as possible because someone else could probably do it better anyway. For the things you are exceptionally good at, take time developing how best to become a teacher of those things, rather than solely the individual contributor.

Hire competent outsiders – build out a management team. This could include dedicated professionals in sales, marketing, finance, and operations. Getting the right people in the right seats and learning to trust them enough to do their jobs is hard. It requires time and patience and the ability to step back and allow the learning curve to play out, even if it would be faster or easier or more efficient for you to do the thing yourself.

Mentor, train, and delegate. This is one of the key ways you can step back from the day-to-day while still having real vision and impact. As your business scales and you release decision-making control, your efforts should be going to identifying new leaders and specialist talent. By becoming a resource for these individuals through early and robust mentorship, you’re setting the table for your business to be run in alignment with your vision while also giving competent replacements the resources they need to carry the business forward.

Document institutional knowledge and key processes. Of course your financials need to be clean and tidy. But if the real knowledge of how to run your business primarily lives in your head, you’re not setting the kingdom up for long-term prosperity.

Scale functions to be truly independent. Titles and trust are different things. We’ve seen a lot of “stepping back” from founders and owners that’s token, at best. If you’re touting an independent sales and business development team but are still insisting on doing your own estimates, you’re not doing it right. If you’ve got a stable of financial professionals but you’re the only signing authority, you’re not doing it right. If you’re holding planning and strategy sessions with your leadership team but ideas, initiative, and progress are still only emanating from you, you’re not doing it right. The idea is to not just delegate tasks, but key authority.

Build the Kingdom

Reducing owner-reliance can be a virtuous cycle. Businesses that can survive and thrive independent of their owners have an easier time attracting outside investors. Businesses with thoughtful and committed outside investors have more capacity in areas like access to qualified talent, diversity of experience, and financial heft.

There are other steps you can take to ensure that your organization is resilient and antifragile (e.g. building in redundancy, which is a separate, frequently expensive, step). But steps to reduce reliance on you as an owner are a critical starting place. And if you’re taking these steps honestly and mindfully, you’ll be able to demonstrate to a potential buyer that leadership is sustainable, distributed, and professional.

Know, too, that you don’t have to get to 100% on your own. Succession planning and navigation can happen alone or in partnership. We frequently get involved with businesses when they’re what could best be described as partially professionalized. Professionalization, in this context, refers to the extent to which operations are not dependent on individuals. Owners of these businesses have taken some of the steps above and have a genuine desire to steward the company to succeed well beyond their personal involvement. But some ties remain – whether because of lack of access to talent, the risk or fear of failing without backup, personal concern around protecting their primary concentration of wealth, personal interests, uncertainty about next steps or the technology or resources to get there, and more.

It’s not easy to intentionally step back from the business you’ve built. It takes humility, self-awareness, and a willingness to temporarily sacrifice speed, accuracy, and quality while you take down self-imposed limits on growth. But if you’re willing to release your grip on the crown, there are partners that will help secure the kingdom.