How to Sell a Business in 2023

Over the last three years, sellers, buyers, and investors have been weathering outsized uncertainty and wild market swings – from disruption to record investment to slowdowns. What can we expect from the market in 2023? The following are excerpts from Tim Hanson and Emily Holdman’s discussion on Permanent Podcast, where they outline where we’ve been, what they’re seeing in the SMB market now, and what those trajectories suggest about the year to come.

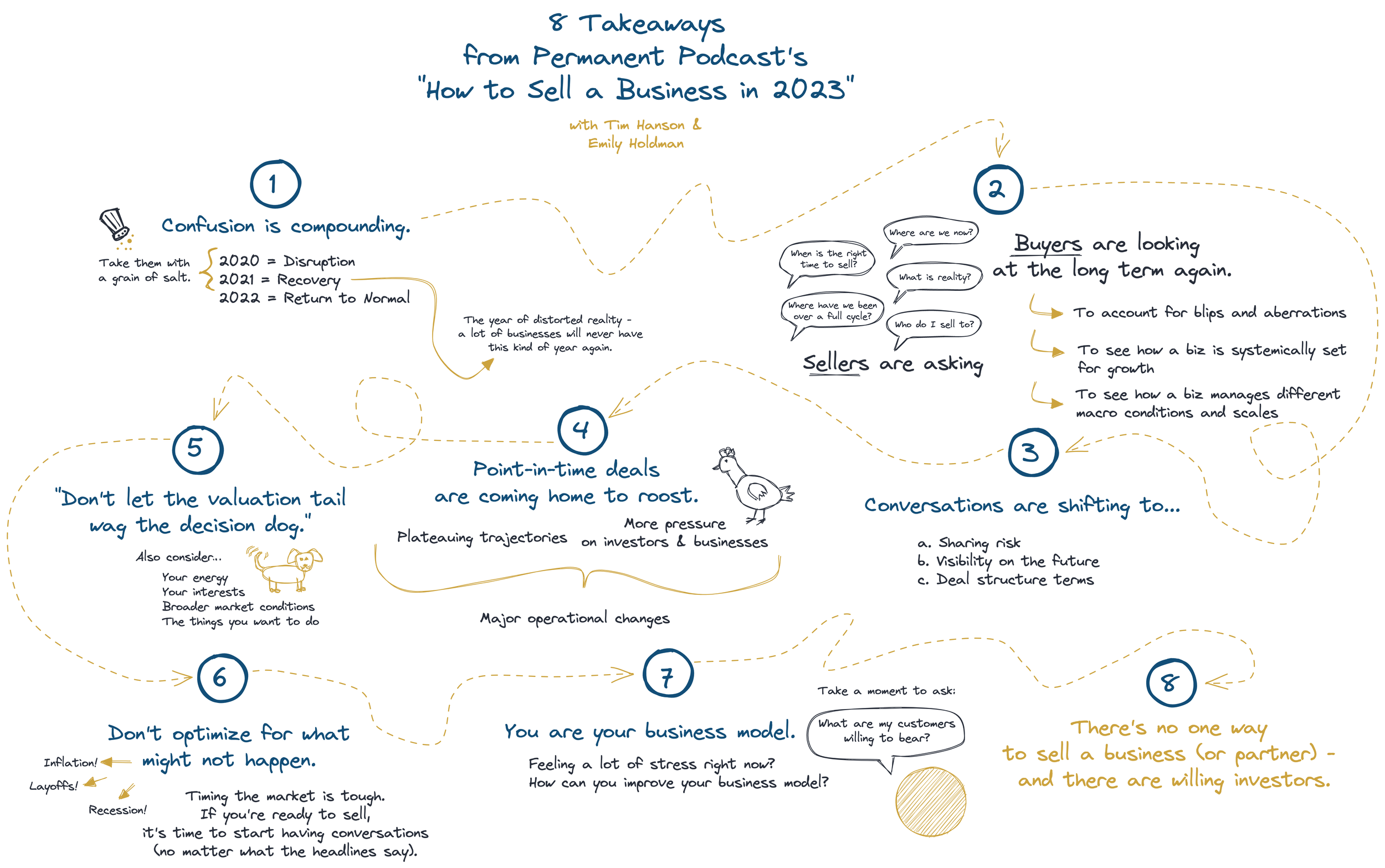

Over the last few years, what has the market looked like for people who are selling a company? Do you see anything changing as we enter into 2023 and beyond?

Emily: A lot of companies had some sort of disruption in 2020. Then, in 2021, we saw a record year of investment across all categoriaes – there were all kinds of deals being done. And now, amidst this confusion, small business owners might be struggling to figure out answers to questions like: When is the right time to sell? Who do I sell to? How should I sell?

That confusion is compounded by the fact that a lot of small business owners hear about transactions among their friends and peers at the country club. So owners are getting anecdotal evidence, headlines about cost control and labor and interest rates, and their own observations of what's going on in their businesses. It can be tough to figure out what reality looks like.

Our opinion is that 2021 was a distortion of reality for everyone. A lot of the deals that got done in 2021 are likely flashes in the pan – they likely weren't done historically, and they probably won't be done in the future.

In 2022, things started to slow down – but that slowdown was mostly a return to normal. By normal, we mean that instead of businesses being sold based on three months of performance looking backward and three months of performance looking forward, buyers were again looking at broader histories of performance. That longer term assessment helps account for aberrations from, for example, a single project and get a better sense of how you're systemically set up to grow. That has to happen over some period of time for it to make sense or mean anything.

Tim: When you're thinking about things as an investor, there are two things that are going to determine whether or not you're successful: What you buy and what you pay for it. Ideally, you're buying good things at reasonable prices.

For example, we talked to a decking company that had historically been inventory heavy – and had been outcompeted by Home Depot and Lowe's for many years. But with the supply chain issues in 2021, those big stores were out of stock, and the decking company was able to sell through years of stock. They had a record year, and they wanted to get paid for it. It's understandable, but that's a hard pill to swallow – they'll never have that kind of year again.

Emily: Everyone's trying to figure out what is reality? Where are you? And where have you been over a full cycle? That's where 2020 can be taken with a grain of salt, and 2021 will probably be taken with a grain of salt as well. In most cases, you'll average the two, and move on. I think it opens the door to conversations that are more focused on risk sharing and how you look at the future. Business owners have more information and greater confidence about their future performance than we ever will.

It lends itself to lots of conversations about how to structure a deal that makes sense in these types of market conditions. These conditions are, again, a return to normal – it just hasn't felt normal for three years. A lot of people are entering the market having not heard about "structure" to a deal, which is and has historically been an important piece in solving for risk between parties.

Q: What’s happening with deals that closed in the past few years? And how should I think about selling now that the conditions have changed?

Emily: 2022 was a shock. I heard many stories last year of a Jekyll and Hyde situation where a firm invested based on the trajectory of 2021. Then the deal is done and the capital stack is what it is. But then the circumstances change, operations go back to normal, and the trajectory softens. For the organization, that means major pressure because that's not what the investor underwrote. That can then manifest in major changes throughout operations – from the whole leadership team being changed out to having people from a firm fractionally spend time in that business and operate as if you're close to the cliff to changing cost structure and operational priorities that work for the deal that was struck instead of what serves the business long term.

That's the nature of a point-in-time deal. If you want to get paid for a point in time, you can do that. But the long-term ramifications for the business are real. We're already seeing more of that – and we'll continue to see more of it in the next couple of years. The amount of debt on some of these companies that did deals in 2021 all but guarantees it.

Tim: If you own a business and you go to sell it, it's a huge, life-changing event. You spent your life building the business, you're now monetizing it in some way, and there's going to be life for the business after you – maybe you're still involved, or not, but you probably still have a vested interest in how that business does.

But, when it comes to that transaction event, sometimes the number one variable people try to maximize for is the valuation or cash at close. There's that old saying, "Don't let the tail wag the dog."

When it comes to selling a business, I'd say "Don't let the valuation tail wag the good decision dog." If you're going to be around post-close, you're going to care who you work with. You're going to care what they're going to do with your employees. You're going to care how they treat your customers.

Another bit of calculus is the public stock market, which was at all-time highs. We're expecting 2023 and maybe 2024 to be slow for deals because valuations are down. But consider, too, if you sold for a very high multiple and then went and dumped your money in the stock market because you had nothing else to do with it, you're down 25% right now [January 2023].

If you sell now, you may get a lower valuation, but if you're going to put your money in a different investment, it's a much better time to take chips off the table and diversify your investment – those other investments are cheaper.

There's a whole wide world of context out there when it comes to making a big, life-changing decision like selling your business. As people are thinking about making good financial decisions, it's important to make them within that universe of context and not just, "Hey, I'm trying to max my valuation."

If you max out your valuation now but end up with a debt-laden company or one that lays off employees and you rolled equity forward, the value of that other stuff is all going to be impaired far into the future simply because you tried to maximize an outcome at a single point in time.

Emily: And there are particular conditions under which that thesis worked. Sometimes investors pay high multiples because they're putting many different businesses together (“rollup”). But if market conditions change, as they have, the deals can become more challenging – sometimes the things you put together no longer make sense. So if you turn out to be the non-core thing added, they may be quick to shift priorities and shed. None of those are going to be good for the team and business that you built.

Tim: The dirty little secret of mergers is that 90% of them fail to achieve pre-merger expectations.

What are headlines about layoffs and looming recession doing to the psyche of someone evaluating their company and exploring a sale?

Emily: A large portion of the layoffs that have occurred have been in the tech space, so it's not directly relevant to most small businesses. Those layoffs aren't going to make the headlines of the Wall Street Journal.

Tim: The thing about predicting a recession is that you'll eventually be right. It usually takes someone two to three years to gear up to sell their business. So by the time you get your books in order, engage an intermediary, get your deck put together, socialize it with potential buyers, a long period of time goes by – and a lot can change in the world in that time.

So if you're not starting to sell now because we might be going into a recession or if two years ago you started the process because valuations were at all-time highs, just know that it's really difficult to time the market. If you want to make a good decision about selling your business, it's always a good time to start thinking about it, as long as you're reasonable about it and are optimizing for multiple things.

We had significant inflation in 2022. The exact amount will be debated by economists and smart people for years to come. That led to the Federal Reserve raising interest rates. And they did that because it increases the cost of borrowing, it slows down the velocity of money, and ostensibly keeps prices tamped down by slowing economic activity. When you raise interest rates, federal government debt is completely credit-worthy. You can get 6% investing in government money, so to take the risk of investing in an illiquid small business, you're going to ask for way more than 6%.

So if you pay roughly 12x for a business, you should make 6%. If you pay 10x, you should make 10%. If you pay 5x, you'll make 20%. As the risk-free rate ratchets up, the multiple that someone will pay for your illiquid small business is going to decline exponentially for those return profiles to be parallel from a risk standpoint. So if I can make 5% risk-free, I'll probably want to make at least 15%, maybe 20% on my small business investment. Otherwise I'll just take the sure thing, 5%, and go on my merry way.

Emily: Usually, at least some of a buyer’s debt is coming from the bank. The bank's willingness to lend and underwrite the small business also changes, and it makes it more challenging. A lot of deals fell apart in Q4 of last year because a lot of banks weren't willing to fund the debt on that deal. And investors weren't prepared to write equity checks to cover the delta between what they were planning to put in in cash and the debt that was no longer available.

Tim: To illustrate the gravity of that, in Europe in 2021-2022, the savings and interest rates were negative. So you actually had to pay money to have a risk-free investment. That's why you saw everybody stretching for any kind of return at all. In order to keep pace with zero, you had to take a lot of risk. That's completely reversed now.

Take venture investing. Venture is risky in the sense that they're young, unproven companies that are probably unprofitable, probably burning through cash, and therefore need to continue to raise money in order to be a going concern. For our businesses, they generally generate cash. So if banks don't lend, it's not the end of the world. Maybe we can't grow as much as we wanted, but the business is generating cash to pay its employees, etc. But for a business that's relying on an external stakeholder (a lender, an investor) to continue to feed you money so you can continue to exist, just to have the status quo, that dries up really quickly in a return environment where the risk profile and the return profile change so dramatically. Which is why those valuations and those layoffs are happening so violently compared to the rest of the economy. It's not a symmetric, linear risk pattern.

Emily: It's almost a 180-degree turn. The major VC investors are telling all of their companies, "You have to focus on profitability. You've got to be able to pay your own employees. You can't rely on the markets to give you cash anymore at the magnitude and in the way that they were before."

In venture, the beloved term is "moonshot." There can be reasons that, for periods of time, even decades, that you would forgo profitability in search of scale, etc. But that's not true for smaller businesses. You're usually working on a more sustainable pathway. So they're different markets, but you end up in a place where venture is making the headlines because they're now having to tell all of their companies, "You need the operational rigor that small businesses are much more used to."

There's frequently much more scrutiny on a P&L for a small business than on a venture-backed company. It's insane, but it's a massive shift for them. That's why you're seeing so many headlines around that.

Tim: We have a saying around here that you're not necessarily your industry, but you are your business model. And so if you're a business that's feeling a lot of stress right now, regardless of the industry, you probably have a challenging business model. And if you're feeling less stressed right now, it's probably because of advantages tied to your business model.

By business model, I mean:

When do you get paid by your customers? Do you get paid up front or do you get paid 90 to 180 days after the fact?

Do you take possession of a ton of inventory, or do you have inventory on demand?

Do you have pricing power? If you were to go away, would your customers actually miss you or could they replace you?

Those are all fundamental business model questions every business owner should ask themselves to help facilitate an understanding of the current environment.

As a business owner, I’m starting to think, "Okay, this is going to be a hard time for me to get what I think my business is worth. I'm just going to batten down the hatches, try to keep growing, and eventually get a higher multiple." Do you think that's a fair thought to have? And what would you say to that person?

Tim: You have to think about your situation and the context. And you also have to think about the time value of not just money, but of your energy, your interest, the things that you want to do. Batten down the hatches is a nebulous elongation of time.

Fast forward two years, four years, five years. Let's say that capital gains rates have changed. Let's say that the gift tax exemption has changed. Let's say that estate taxes have changed. Let's say that interest rates don't go down. Let's say you have a health crisis or you have a health crisis in your family.

If you're ready (emotionally, physically) now to start the process, do it. Yes, your headline valuation is probably going to be lower this year than your buddy's was two years ago. But when you mix all the ingredients of a successful transaction and transition together, I think the environment is in some ways more favorable because you've got very favorable tax laws for the time being. You have an environment where it's easy to make other investments, to diversify. If you've got other things you want to do with your time... Not selling has a cost, too. But we all do this; we see visible costs and we ignore the hidden costs of things.

Emily: There are also broader market dynamics to keep in mind. I think it's incredibly unlikely that people are going to pay what they paid in 2021 any time soon. From an investor's standpoint, a lot of the organizations that were hyper-aggressive in that market and paying the high valuations are in crisis control at this point in time. It was a hard lesson to learn; people in those firms are saying, "We'll never do it again."

Tim: Overpaying for something is one of the most stressful things you can do. It's a hugely stressful thing to have that loss hanging over you. And it manifests itself in lots of weird ways on a business. In some ways I think it's worse than debt.

Emily: There probably was a period of time in which you were top ticking the market, and that was likely in 2021. It's likely not to be seen again soon. So optimizing for something that may not happen again seems like you're betting against your health, against your interests, against how you want to spend your time.

There are still lots of firms, Permanent Equity included, who have money that we would like to put to work. In that way, you have a willing set of investors and people who want to partner. These people are eyes wide open about the current conditions. If you want a bigger sounding board, if you want more people in the boat with you, there are lots of reasons to say this might be to at least initiate conversations.

Take deal structure, for example. Ultimately, it’s a conversation about how much you want to take now and how much do you want to bet on the future? Cash now is an exact value for what the buyer can underwrite in the present. But you can always say, "I'll take more money, but I'll take it later with some sort of structure around performance indicators for the business." You may see that that's the best path forward for you.

I would encourage people who are thinking about selling to initiate conversations knowing that there's not one way to sell a business, and you don't have to sell for cash today in order for it to make sense.

On our side of the house, we still don't use leverage; we're still making the same offers. We were just getting outbid in 2021. It was an interesting market for making deals. We still successfully made investments that year, and we've successfully made investments throughout this period. But there were crazy offers being made. The point is that our offers and how we’ve underwritten businesses have been consistent throughout this period. Because we don't use leverage, we didn't have to come down two turns on what we were offering to enter into 2023. The banks and their rates don't affect how we look at opportunities.

Tim: We don't use other people's money. In most private equity, investment firms are cobbling together multiple classes of capital to make a deal. They have a diverse set of funding, all of which has different costs associated with it. So there's bank debt, there's mezzanine debt, there's equity capital. These are all places you can go find money, and these people will give you money for different costs. Because we're only using our own fund capital, the cost of that capital has been consistent every year.

The biggest competition to us and our value proposition is to figure out a way to keep it. Set up your own transition or succession plan, keep your equity, make sure that it generates cash flow for you and your family, and turn it into a multi-generational enterprise. Because there's no friction, there's no taxes, that's a really hard value proposition to compete with. Now there are a lot of reasons why people can't do that. But if you can figure that out, that's great.

For more conversations like this one, subscribe to Permanent Podcast on your favorite podcast app.