Unqualified Opinions 4/17/23 - 4/21/23

By Tim Hanson

How to Become a Good Investor (4/17/23)

We recently launched a new program at Permanent Equity with the goal of hiring investment analysts for a predetermined period to help us increase our deal flow and help them become better investors. Here are the details of the program, but what I hope is most interesting is the idea that we intentionally didn’t overengineer the details and are interested in candidates with a broad range of backgrounds and experiences.

Not a CFA? Not a problem.

Never built a DCF model? We can teach you how to do that.

Don’t know what an Iron Condor is? I wish I didn’t either.

The reason for that is there is no clear cut expertise that makes someone a good investor. Math matters, sure, but so does temperament, curiosity, communication, salesmanship, confidence, humility, and so much more. Moreover, the way we do it, investing is a team sport, so it’s also important that you fit but also don’t in such ways that it makes our team stronger and more resilient.

Finally, I’d add that I don’t even know that I’m wedded to some of the preferred qualities we listed. Are they preferred? Sure. But these two right here would have meant that a version of Past Me would not have been qualified for the job.

The point is that I think anyone can become a good investor regardless of where they’re starting from. The key is getting real reps and transparent feedback to find the approach that works for you. Those things are each easier said than done, of course, but I think we can offer both.

The Cause of and Solution to Life’s Problems

(4/18/23)

After I wrote about Growth, and Other People’s Money, I received a thoughtful note from @michaelnewt. He wrote:

OPM can be addictive. It changes behaviors and incentives…Mathematically it makes sense to go with the cheapest capital, but your write ups on OPM and Debt vs Equity are the reminders I needed to think deeper on the issue. There is more to choosing the best partner than simply what Excel tells us to do.

I joke that Excel is the cause of and solution to all of life’s problems. That joke is a riff on an old Simpsons episode that said the same thing about alcohol. And I’d argue that they are not dissimilar. In moderation, both are great, but if you let your life be run by spreadsheets or booze, well, you have a problem.

Keep in mind that I say this as someone who has a spreadsheet for everything.

Household budget? Spreadsheet. Son’s swim times? Spreadsheet. Distribution of wildflowers in a native Missouri wildflower meadow? Spreadsheet. But I have to remember that as much as I love a numerical safety net, data is a way to help you make decisions, not to make decisions for you.

In fact, I’d argue that one of the most dangerous situations you can find yourself in is one where “the numbers make sense.” If you’re falling back on the fact that the numbers make sense, then it may be the case that the sense doesn’t make sense. This, I think, is how people got lured by low interest rates to buy too much house in the mid-aughts or how a financial institution like Silicon Valley Bank got lured to buy long-dated slightly-higher interest rates treasuries more recently.

In both cases the numbers made sense, but the decisions turned out to be bad ones.

There’s a saying that numbers don’t lie, and that’s true. The learning, though, is that people can and do lie, both to themselves and to others, and often use numbers to do it.

Don’t Perform, Perform, But Also Perform

(4/19/23)

After I wrote about Permanent Equity’s secret formula, I received an email reply (which I love…if you reply to this email it goes directly to me) from someone who said “I’ve been involved with companies for more than 25 years and keep getting caught up in the ‘what people think you need to do or want to see’ perspective.”

I think this was mostly a reaction to the idea that we don’t require our portfolio company leadership to be good at PowerPoint animations and that one shouldn’t spend time on activities that don’t actually move the needle. But it’s also true that it doesn’t hurt to be good at PowerPoint animations.

What am I talking about?

I made the observation on Twitter that back when I ran an investment team, the ideas from extroverts were overrepresented in our portfolio vis a vis the ideas from introverts. The reason was we had a process that required analysts to present their ideas to a group and introverts were not as good at that as extroverts. And that wasn’t fair to the introverts or a very good process, which I think is a point that stands.

But SuperMugatu aka Dan McMurtrie (a very smart investor we know) responded “I agree with the virtue of what you’re saying but have been seriously burned by people with poor communication skills.” And he’s got a point too.

When I was first starting out as an investment analyst I was taken aside and told “Look, you’re not going to be judged by all of your ideas. You’re going to be judged by the ideas clients actually take action on. So, you have to always be selling.”

That’s why it can pay to be good at PowerPoint animations. They’re a means to convincing others that your ideas have merit. Yet it’s also true that if you’re always performing for others, you won’t have time to spend on efforts that actually generate good objective performance.

This can be thought of through the product/packaging paradigm. In order to be successful, you need a good product, but you also need to put that product in attractive packaging that is enticing to consumers. In other words objective performance and performative performance go hand in hand, but striking the right balance can be an ongoing challenge. If you tilt too far to the former without the latter, you’re the proverbial tree falling in the forest that no one hears. But if you’re the latter without the former, you’re, as they say in Texas, all hat, no cattle.

Who Holds the Float?

(4/20/23)

It turns out that David (our creative director) is passionate not only about high quality content, but also March Madness. This was probably helped by the fact that his alma mater Mizzou made the tournament as a frisky 7 seed (although the high variance team flamed out in the second round), but motives aside it was good for the office vibe. We made t-shirts, ordered wings, had contests, and watched the games. Of course, he also administered a bracket challenge. It was $10 to enter and he required that you pay upfront (the Challenge, I might add, was won by my daughter who picked San Diego State to win it all).

Ever the imp, I poked him on Slack. “Why do you get to hold the float?” I asked.

“Because it’s not my first rodeo,” he replied. “Coordinating who owes what to who at the end is a mess. Pay to play is the way.”

Which is completely a fair point, but I can never leave well enough alone. Now, for the rest of this exchange to make sense, you have to know two details:

David briefly way back when dabbled in speculating on obscure cryptocurrencies, including Polkadot.

When I think something is funny, I never let it die.

Two observations. First, it’s amazing to me that “pulling out to fiat” is part of our vernacular now. Second, even in this small example, when you pay or when you get paid and what happens to the money in between those events matters.

The term for this is “float,” and it’s how Warren Buffett built his empire. Here he is writing in his 2009 letter to Berkshire Hathaway shareholders:

He estimated that year that Berkshire’s insurance operations provided him with $62 billion of other people’s money to play with. Not bad work if you can get it, particularly if you have the investing acumen of Warren Buffett and can put that money to work making more money.

What’s the takeaway?

If you run anything from a small NCAA office pool to a multinational conglomerate, think carefully about when money moves and who gets to hold the float. If it’s not you, why not? If you’re floating other people, why? And how might you stop?

But if you do get the float, crucially don’t do something stupid with it because you’ll have to give it back eventually. Or “pull it out to fiat” as I guess the kids say.

And More CIMple Truths

(4/21/23)

As always, we have empathy for the analysts at investment banks tasked with putting together lengthy decks about small private businesses (aka Confidential Information Memorandums or CIMs). Information is often incomplete or missing altogether, there are skeletons in the closet, and the people approving your work probably don’t appreciate how difficult it is to make a color pop.

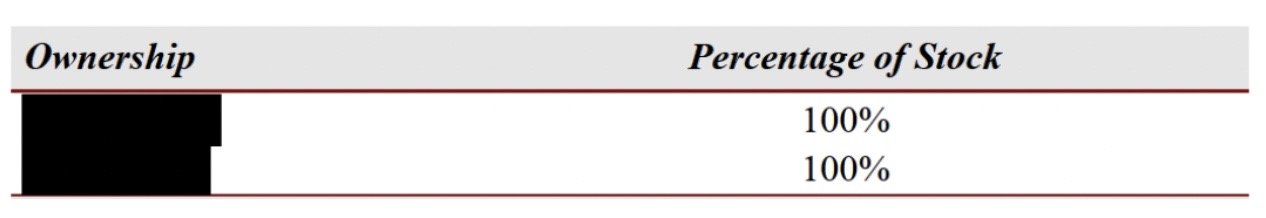

That said, we occasionally see some things that make us scratch our heads. In no particular order…

Fake numbers and made-up words

Tremendous synergy.

Announcements that say nothing

Congratulations to someone for something!

Needless hedging

We didn’t do that already?

Numbers that don’t quite add up

Wait, what?

Have a great weekend and shoutout to Danny Coffeepot for his help on today’s Opinion.

Want Unqualified Opinions delivered to your inbox every weekday?