Important Metrics for Small and Mid-Market Companies – Part 3: Team

This post originally appeared on Medium.

Getting data is never the problem. In fact for most executives, information can be overwhelming. Getting accurate data and interpreting it appropriately is an entirely different story.

In The Ceiling of Brute Force, we discussed what operational areas impede a company from continued growth. In a series of posts, we’re going to break down 19 of the most important key performance indicators (KPIs), which demonstrate how effectively the business is being run. Think of KPIs as the canaries in your coal mines. If one starts going south, you know it’s time to take a closer look.

Presented in a five-part series, here’s our take on what you should pay attention to, allowing you to focus your time, effort, and dollars. The five parts are: Basics, Customers, Team, Operational Efficiency, and Investment. In Part 3, we’re presenting key metrics on the group of people that make your company function: leadership depth, employee tenure, and payroll ratio.

1. LEADERSHIP DEPTH

KPI Objective: Know how well-equipped your team is to execute, even in the possible absence of key contributors (a.k.a. redundancy).

Tracking your leadership depth is similar to how coaches track their team depth chart. Who plays QB if the first-string gets hurt? Who plays if the second-string also gets hurt?

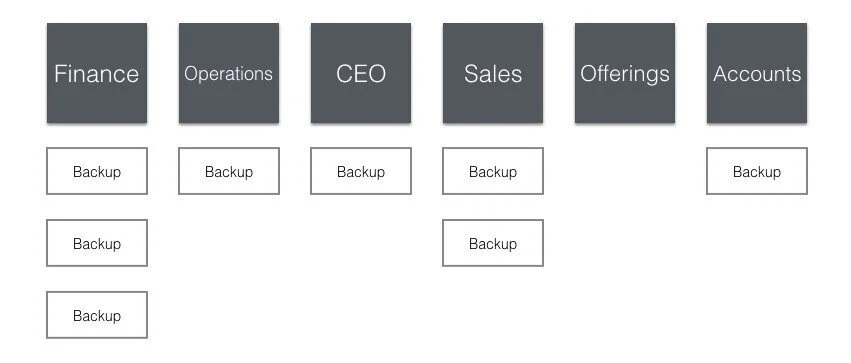

Your leadership depth chart tracks, in essence, your dependency on any individual and your ability to scale. It can be tracked visually in an actual chart, or in any way that allows you to understand where people have been cross-trained and roles they are capable of taking over, if needed or desired.

2. EMPLOYEE TENURE

KPI Objective: Know how long employees remain part of the team, and what causes them to leave.

As with customer tenure, employee tenure is generally an indication of good health. Employees with years of experience, if properly led, are more profitable resources for the company, possessing greater understanding of operations and higher productivity.

In contrast, rising rates of attrition may indicate issues with company culture, compensation competitiveness, leadership, or general lack of enthusiasm about the company’s future.

3. PAYROLL RATIO

KPI Objective: Know appropriate staffing levels and how much labor is necessary to achieve your goals.

The most commonly used payroll ratio is gross payroll to gross profit, measuring what portion of gross profit is taken up by manpower during a specific period of time. Gross payroll is the total before any deductions for payroll tax or benefits programs.

Depending on your structure, it may be useful to go one level deeper, creating ratios for groups of employees, whether that’s large groups (i.e. revenue-generating vs. cost centers) or by department (i.e. sales team vs. accounting team). At this level, profitable departments will stand out, and understaffing or overstaffing can be more easily recognized.

On a related note, it’s also useful to track compensation competitiveness, both by industry and region. Industry associations and government bureaus can be good resources for finding benchmark data, as can occasionally asking friendly peers in your industry. If you’re overpaying, or underpaying, do so knowingly.