Owner/Operator Covid-19 Impact Survey

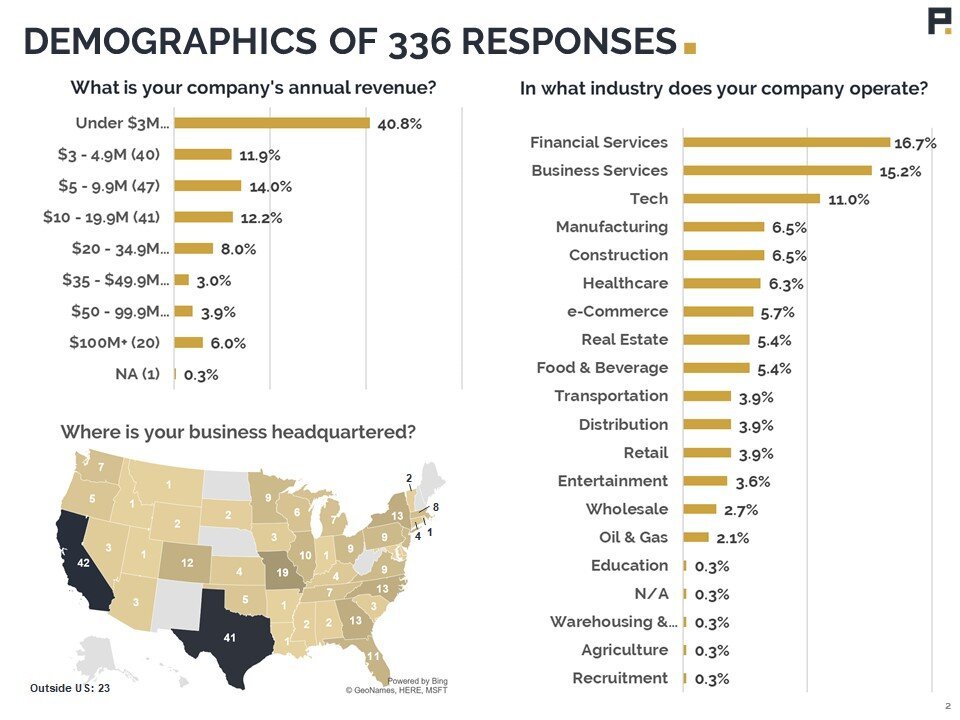

Last week we asked Owners and Operators of small businesses to help us put some numbers on the impact of the COVID-19 pandemic. 336 owners/operators from 43 different states opened up about how the virus and the ensuing economic shutdown have changed their businesses. While the data reveals serious challenges, we were repeatedly encouraged by the optimism of small business owners. There are struggles ahead, but in the long run the same entrepreneurial spirit that drove each of you to launch your business in the first place will lead us to the other side.

We’ve put together a short write-up of the key findings as well as a slide deck that walks through each question in detail. Our hope is that producing this analysis helps us all understand the landscape a bit better, helps us feel less isolated as we navigate uncharted territory, and communicates to those outside the small business community the magnitude of the situation.

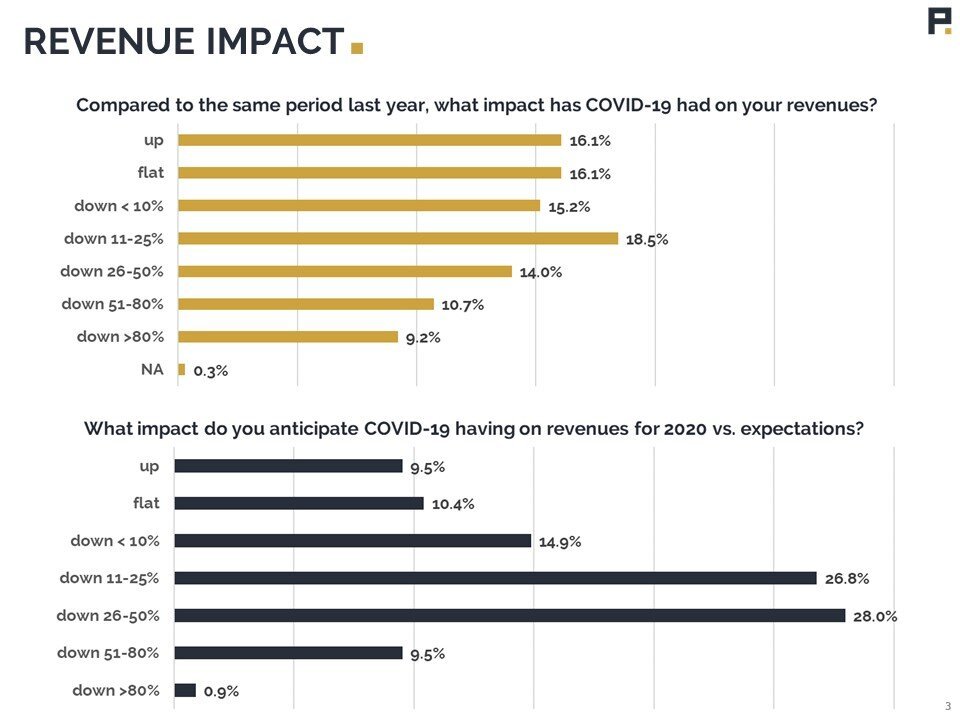

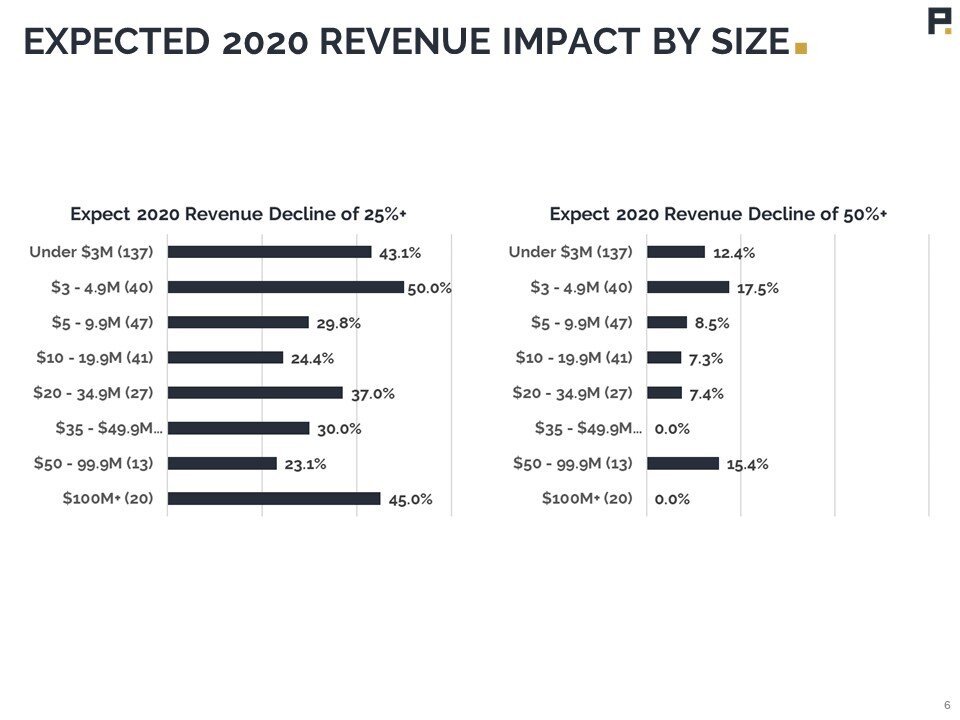

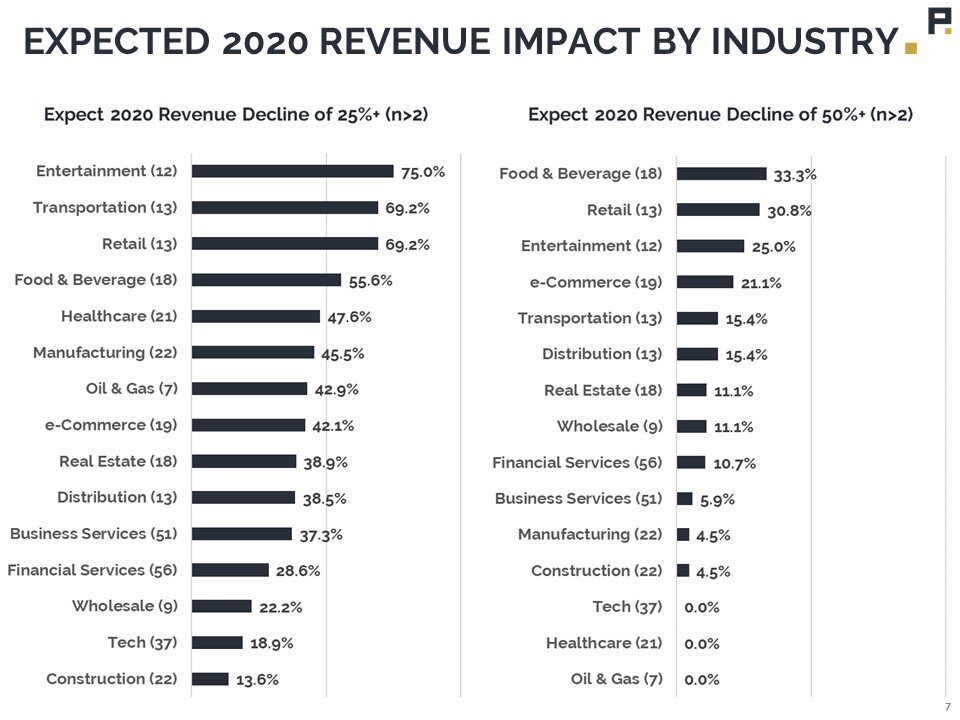

Revenue Impacts

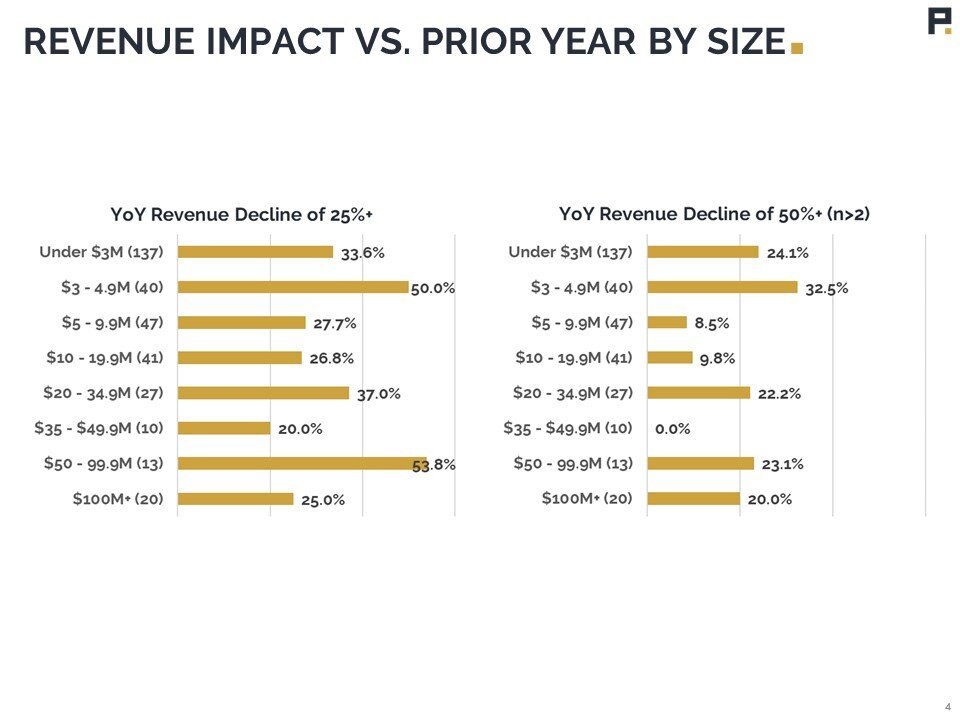

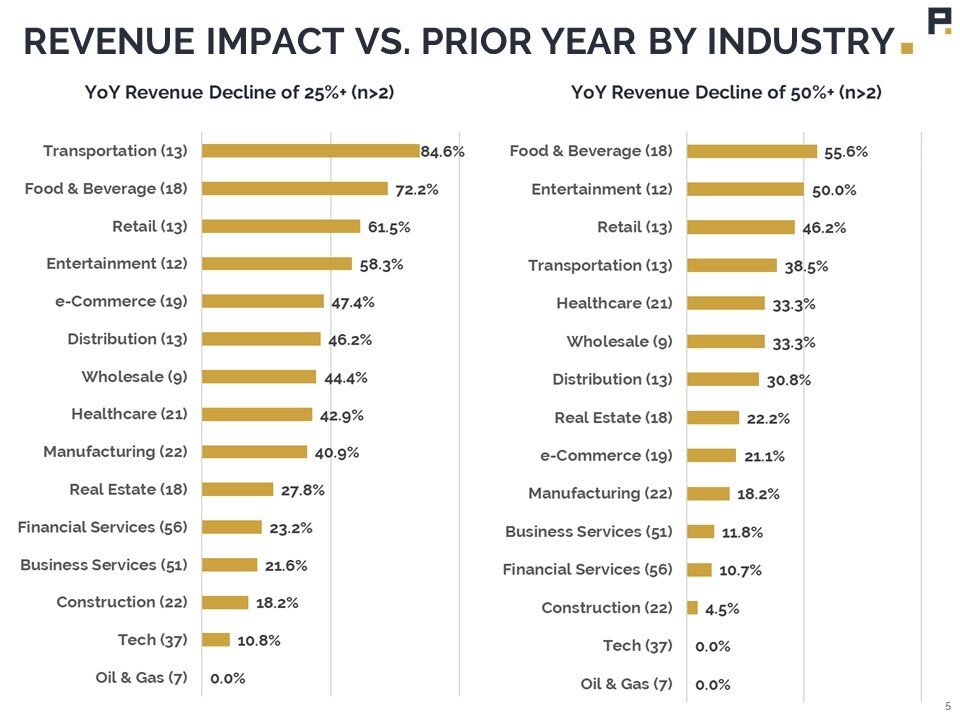

Many small businesses are already feeling a significant impact on revenue, with a third of respondents reporting a 25%+ drop in revenue versus the same period in 2019. This drop has little to do with company size and everything to do with industry. At or nearly 50% of respondents in Food & Beverage, Entertainment, and Retail reported year-over-year revenue drop of 50% or more due to the effects of the pandemic.

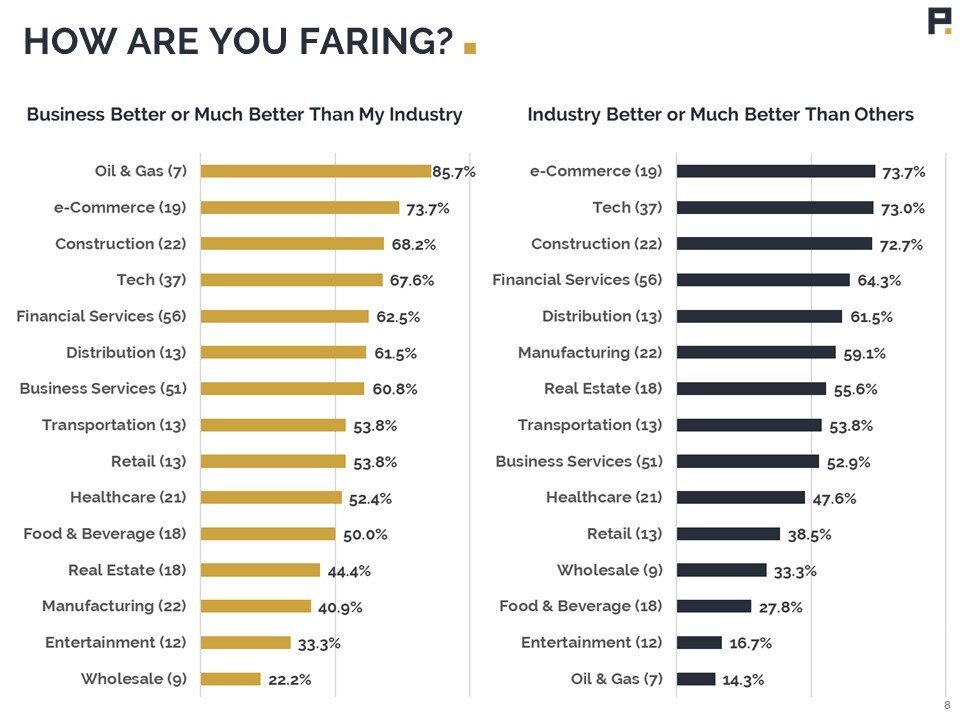

The response to this drop is tempered with the optimism necessary to be a great entrepreneur. Less than 4% of respondents believe their business is doing worse than others in their industry. While 20% of companies reporting have experienced a revenue decline of 50% or more, only 10% of companies believe that will persist through 2020. We’ll see more of this fighting spirit later in the survey

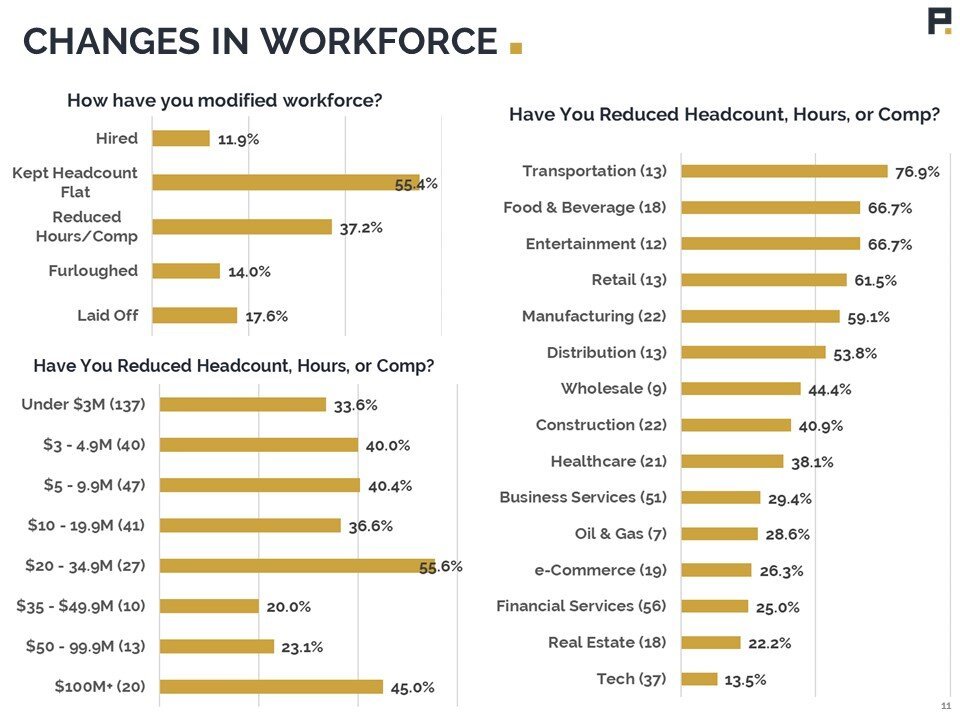

Workforce Changes

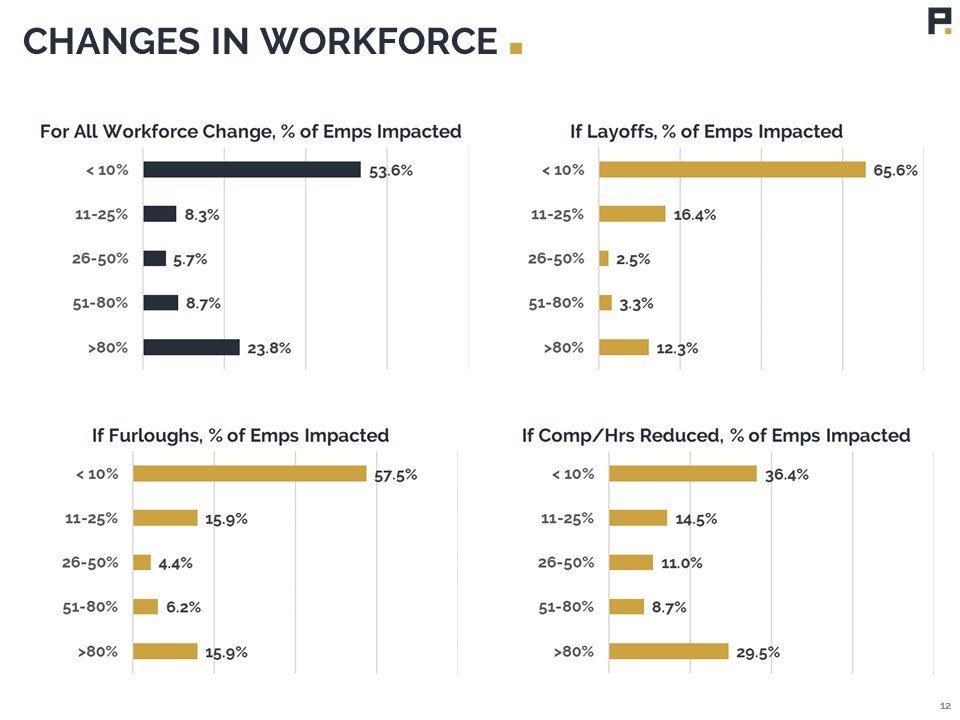

37% of those surveyed have already made changes to their workforce, either by cutting hours and/or compensation, enacting furloughs, or laying off employees. These changes tend to be either highly concentrated or very widespread, with 54% of companies making alterations impacting 10% or less of their workforce, and 24% of changes impacting 80% or more of their workforce.

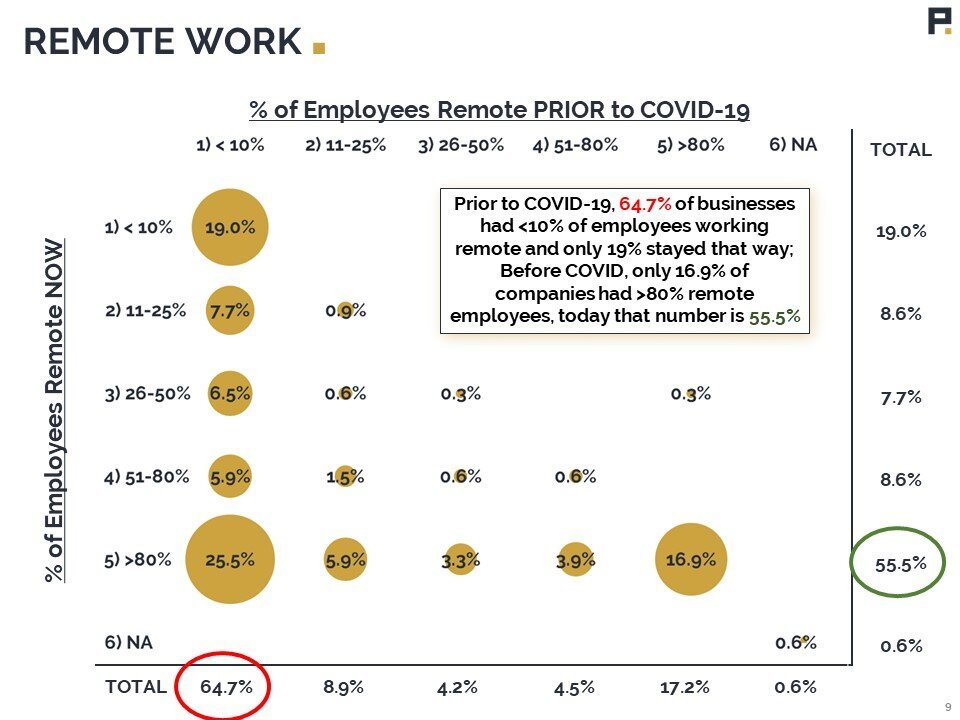

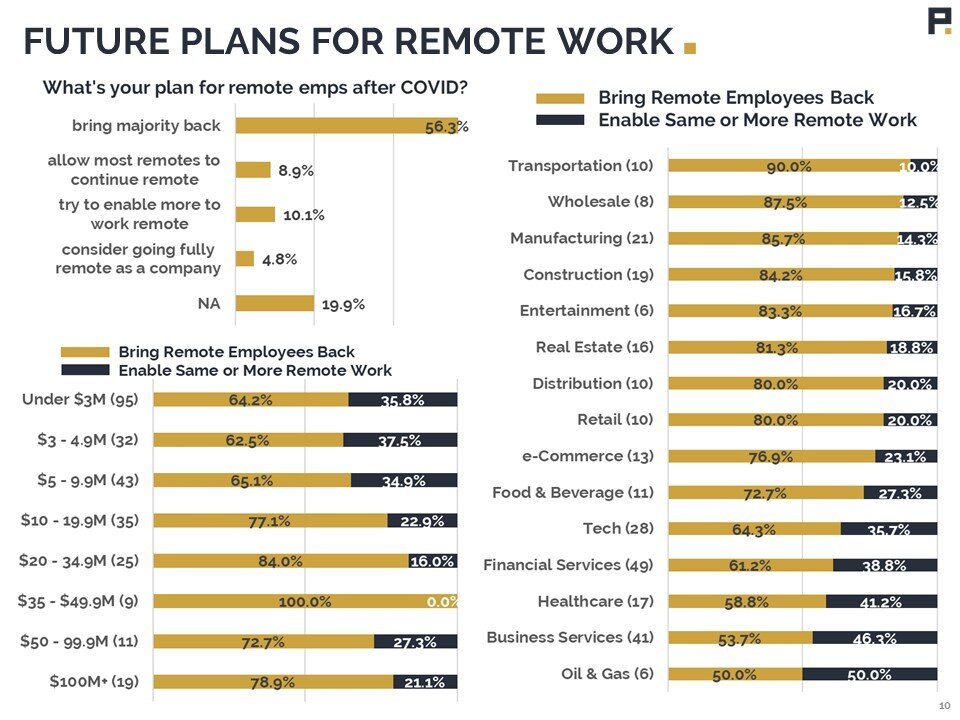

Employers have also taken dramatic steps to keep employees out of the office. Before COVID-19, 65% of businesses reported having less than 10% of their employees working remote. Now 56% of businesses have >80% of employees working remote - a massive shift. But the shift appears to be temporary, with 70% of businesses not planning on expanding remote work after the crisis has passed. There is high industry correlation here, with Transportation, Wholesale, Manufacturing, and Construction obviously needing to bring employees back to be productive again. But some resistance to remote work is seen based on company size as well: of companies generating less than $10M in annual revenue, 36% are considering expanding their remote workforce post-crisis versus 19% of companies above $10M.

Finance Changes

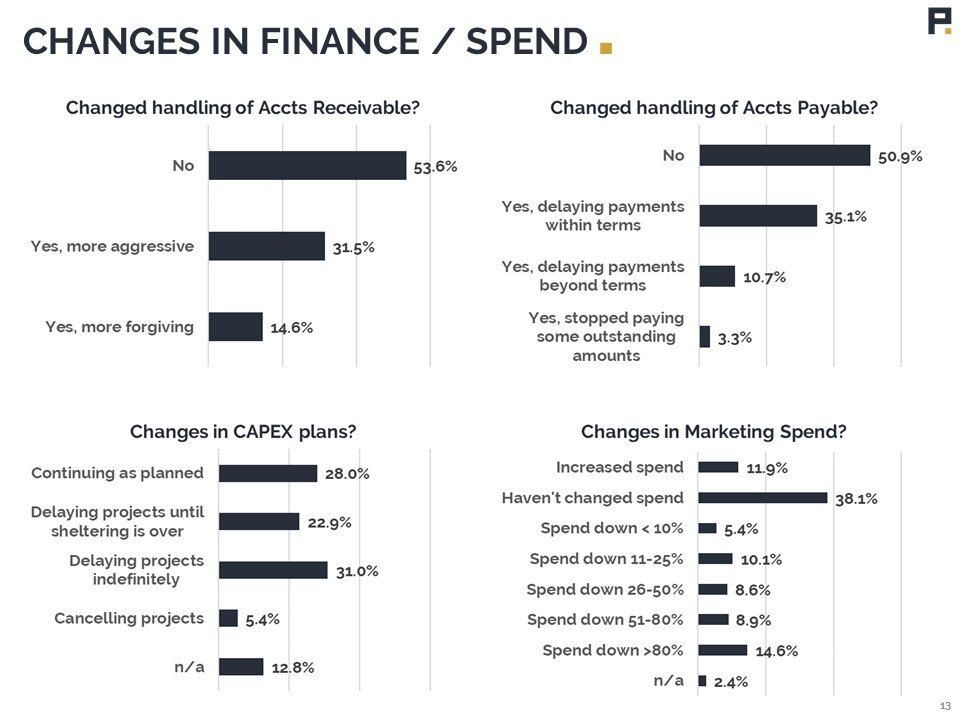

The financial pinch being felt is evident in how companies are handling their Accounts Payable, with nearly 50% of respondents having altered their policies already. Further, 14% report delaying payments outside of the terms of their agreements or not paying altogether.

Of those responding to the question, 68% of businesses are delaying their plans for Capital Expenditures, with 42% either delaying indefinitely or cancelling completely. Interestingly, 50% of respondents have made no cuts to their marketing budget, but another 24% report slashing their marketing spend by 50% or more.

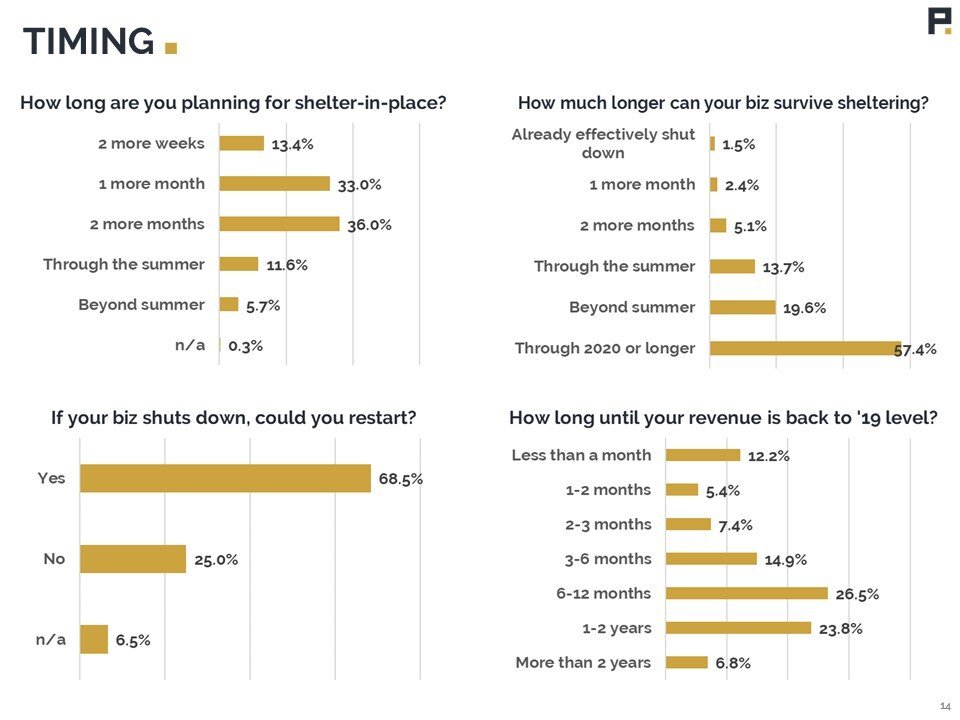

Timing and Sheltering

Most owner/operators are optimistic about shelter-in-place orders lifting quickly (supported by recent news from state-level decision makers). 82% are making business plans based on sheltering lasting 2 months or less and less than 6% expect sheltering to have an impact beyond the summer.

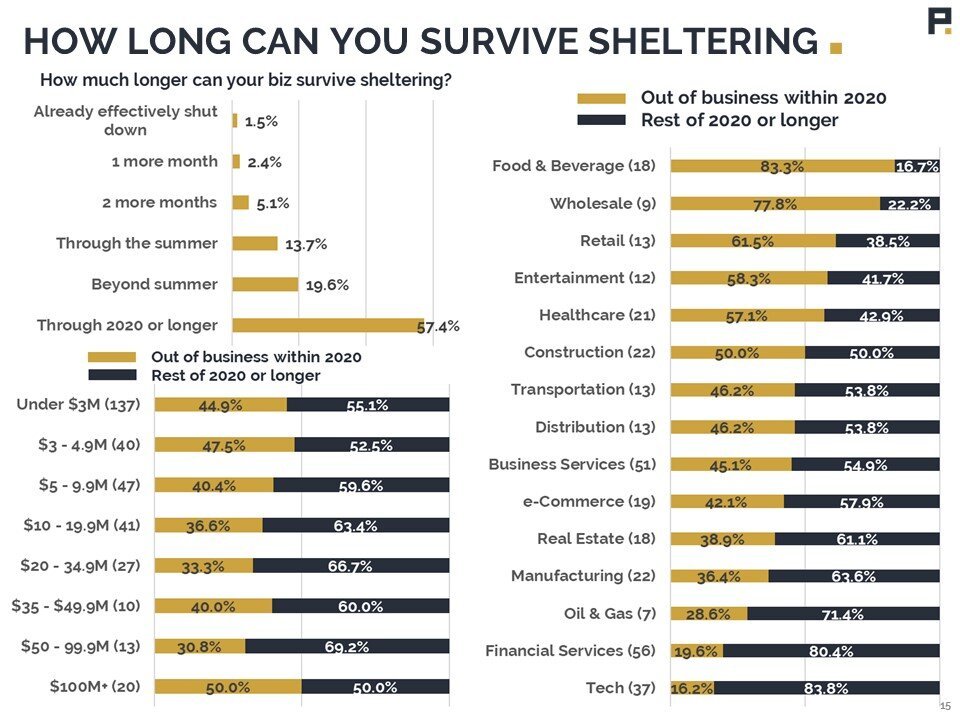

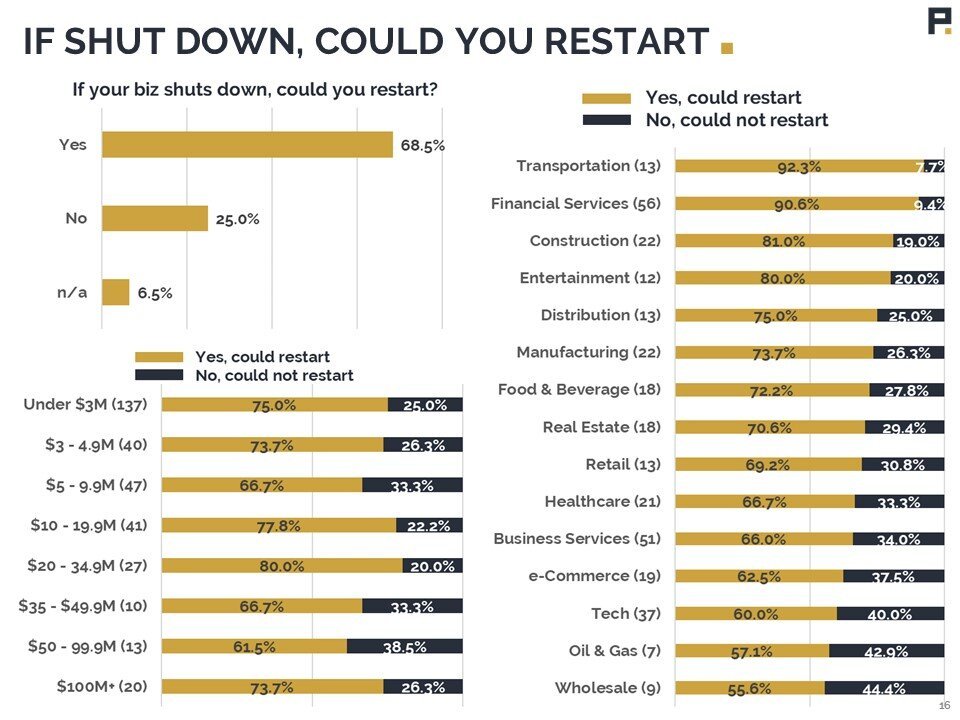

A majority of those surveyed are also confident in their company’s ability to survive. 57% report that their business could survive sheltering that lasted through 2020 or longer. Nearly 70% would be able to restart their business in the event that it had to shut down. Both of these metrics are highly driven by industry and are detailed in our report. As an example, Transportation and Entertainment are among the hardest hit industries, yet over 80% of respondents in these industries believe they will be able to restart should they have to.

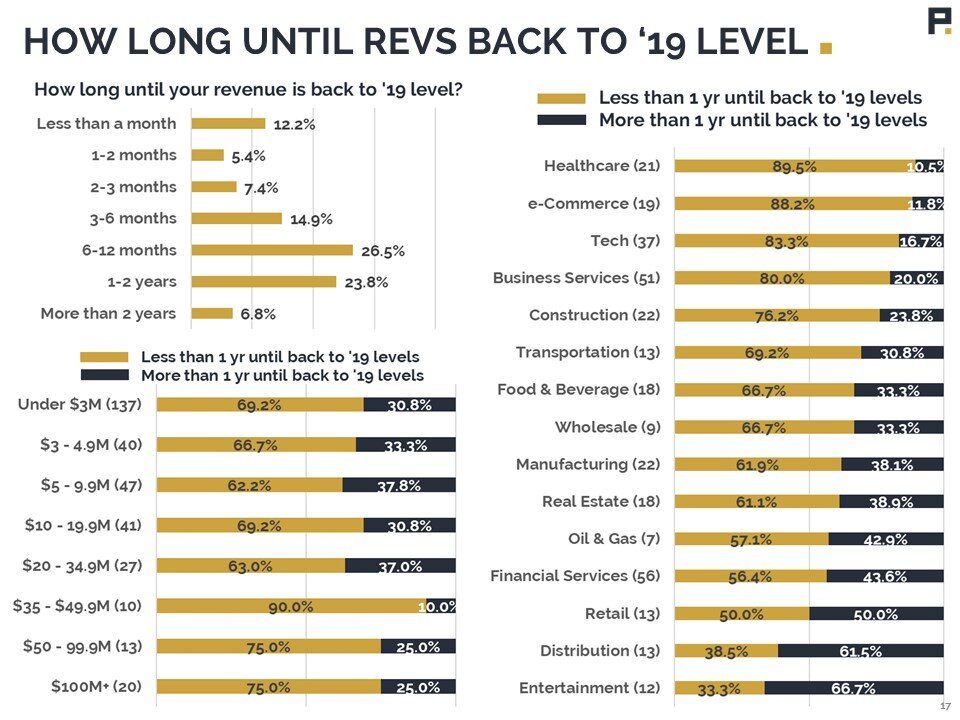

Opinion is mixed, and again, highly industry-correlated, on when revenues will return to normal. In aggregate, 40% of owner/operators believe it will be less than 6 months until their businesses see 2019 revenue levels again. Healthcare, e-Commerce, Tech, and Business Services are among the most optimistic, with 80% of respondents in these industries believing it will be less than a year until they reclaim 2019 revenue levels. For others, the road appears to be longer -- 50%+ of participants in Retail, Distribution, and Entertainment believe it will be more than a year until 2019 heights are achieved again.

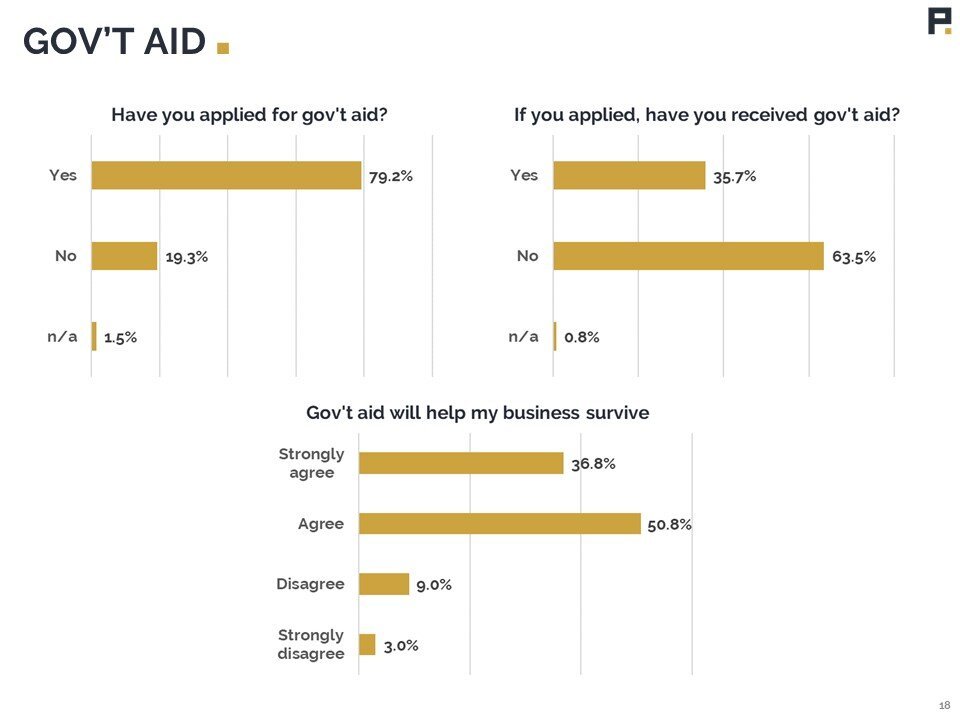

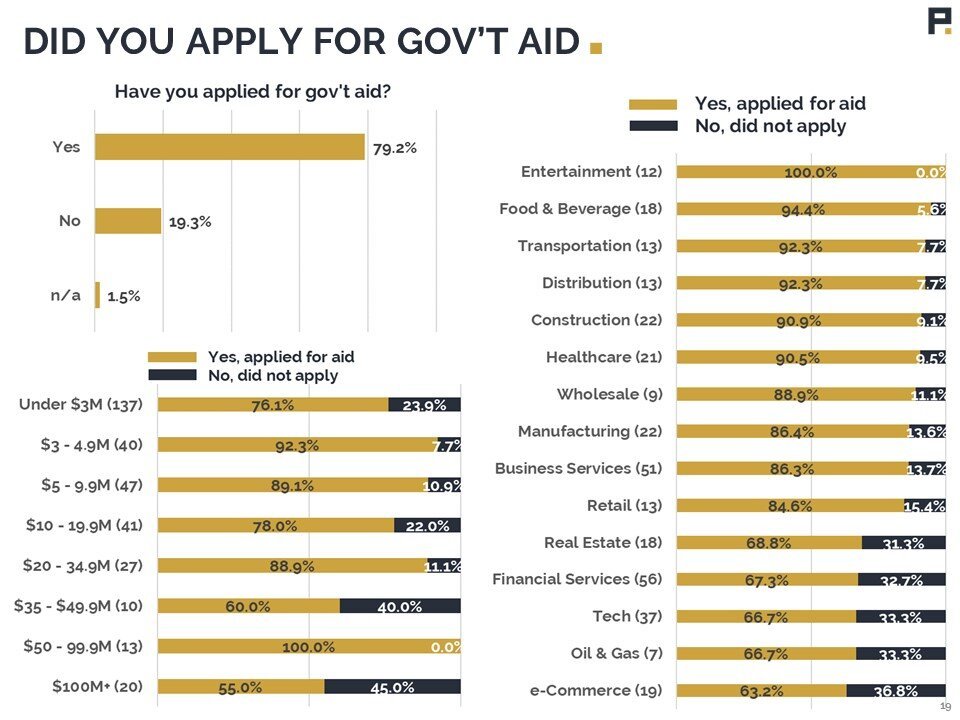

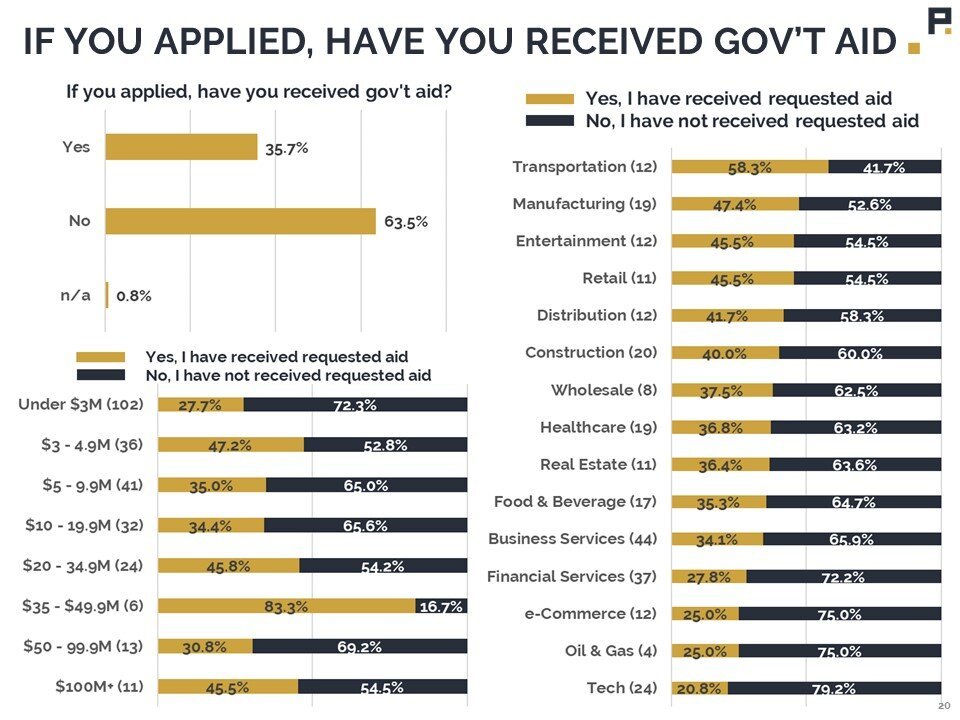

Government Aid

88% of respondents believe Government Aid will help their business survive, and it shows. Nearly 80% of those surveyed have applied for some form of aid since the start of the COVID-19 shutdown. Of those who have applied, only 36% had actually received that aid as of the time of this survey. With a fresh batch of spending approved by Congress today, we hope that number will increase dramatically over the next few weeks.

Optimism

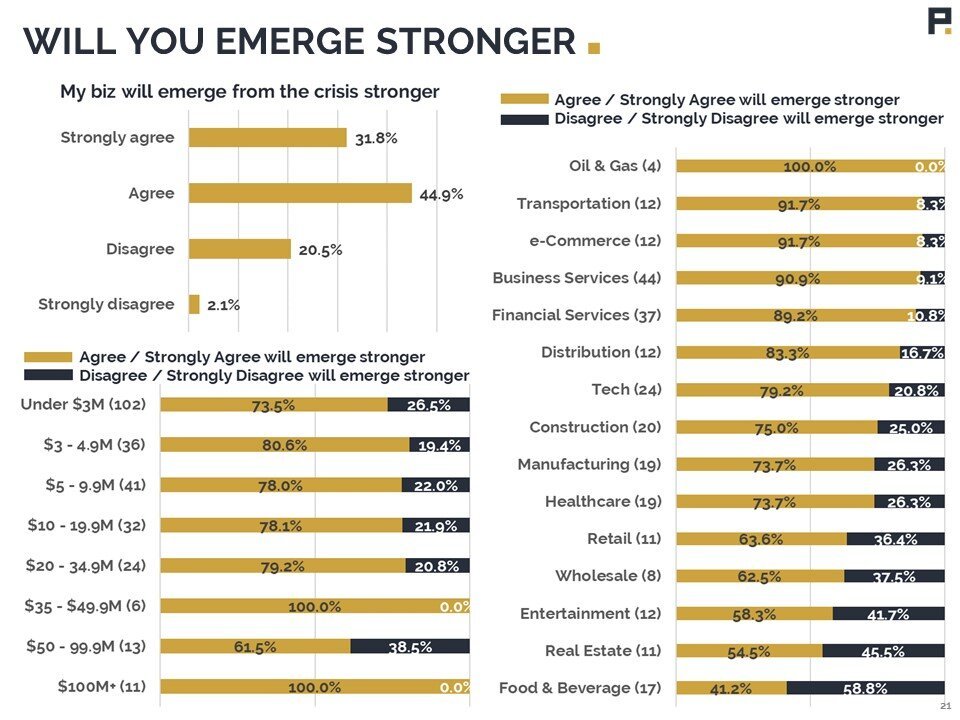

Despite some bleak numbers, our respondents indicate the entrepreneurial spirit that drove owner/operators to build their business in the first place is still alive and well. 77% of respondents agreed with the statement that their business will emerge from the pandemic stronger than before.

Closing Thoughts

It’s clear from the data that owners are short-term worried and long-term optimistic. They’re taking steps to match the workforce to the situation both in terms of appropriate size and work style. They’re seeing and anticipating historic drops in revenue, but confident they can weather the storm, especially with government assistance. This matches our anecdotal conversations. The owners and leadership teams we’ve had the privilege of chatting with recently have been passionate, gritty, and ready to do whatever they can to protect their organizations and continue serving their customers.

If you’re an owner or operator whose business has been hit hard, hang in there and know you’re not alone. From our team to yours, we’re pulling for you and available to help.