Can Main Street Innovate?

It feels good when people ask for your opinion on something, so it made my morning the other day when I had a notification on X nee Twitter from one Chris Unsworth. His question?

“Is Google’s 20% time idea applicable to Main Street business?”

What he’s referring to is the policy (perhaps apocryphal, though promoted at the time of the company’s IPO) that full-time Googlers are supposed to spend 80% of their time on the clock doing what they were hired to do and the other 20% on something of their choosing that they view as innovative or high potential. This allegedly led to the creation of Gmail as well as AdSense and Google News and made the company a desirable place to work.

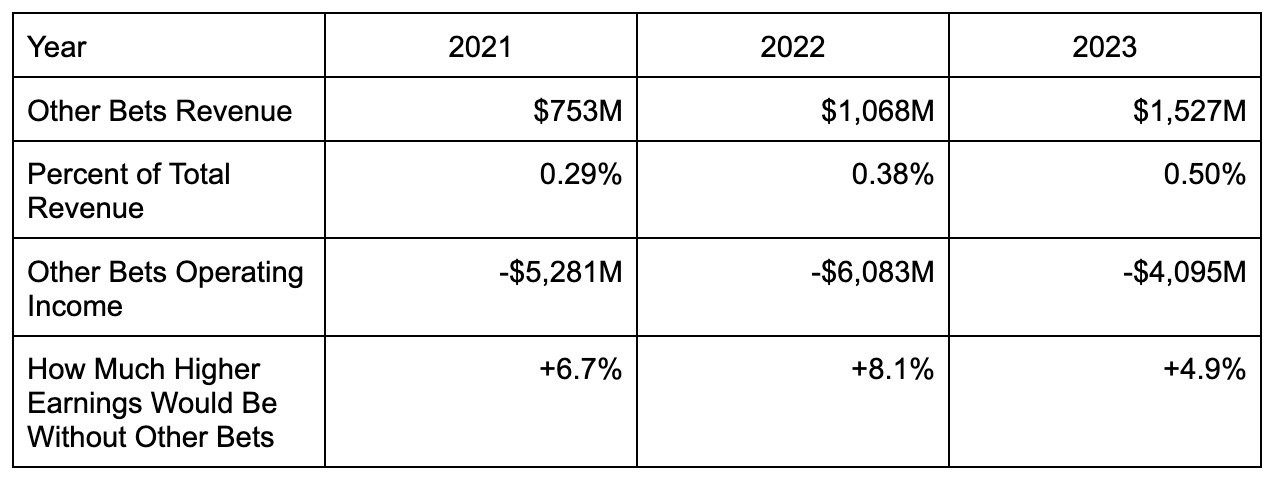

This, however, is an undoubtedly expensive policy for Google to maintain with uncertain return potential. And while Google’s parent company Alphabet doesn’t provide the world’s most transparent financials to investors, you can see in recent results that its “Other Bets” segment (where one might expect these novel ideas to be housed as they are commercialized) is contributing little to the company’s top line while being a significant drag on profits.

Further, you can see that under pressure to be more profitable last year, this is one area where Alphabet opted to cut costs.

The argument for spending 20% of your day on unprofitable, non-core stuff, however, can be summed up in the widely-held business aphorism that if you’re not growing, you’re dying. The world, after all, is cutthroat competitive and if you’re not getting better all the time (and not just incrementally better) someone else will drink your milkshake.

At this point, it’s probably worth unpacking what a “Main Street business” is. This is one that’s relatively small, a community employer but without access to A+ talent, probably geographically constrained, profitable but a few bad months from being not, and private. There are tens of millions of businesses like this across the US that employ some 20% of workers. And the question is “Can these businesses afford to let workers spend 20% of their time on unprofitable, non-core (albeit innovative and high potential) stuff?”

The answer is probably not. Bankruptcy filings in this segment were up more than 250% in 2023, with a main driver being higher financing costs eroding already thin profit margins (and that’s if many of these businesses could get their customers to pay them). This leaves little money left over to invest in innovation that might eat up 5% to 10% of the bottom line, leaving aside (and apologies if this sounds patronizing) the fact of whether small business operators can even trust their employees to know how to spend that time.

But they also have to do something. Consolidation is a real trend, and if you’re only playing defense in anything, you will eventually lose. It’s just a question of how long it will take to meet your end.

So how might Main Street businesses innovate and remain solvent? That’d be a good topic for a panel at Main Street Summit later this year, but one answer is to make only targeted bets. Keep a list of everything your business might do to grow or innovate, but force rank them based on return potential and difficulty of implementation and only tackle one or two at a time having established a finite budget and clear milestones to track progress. Another is to watch competitors and industry peers like a hawk and be shameless about trying things they are doing that might be working (effectively letting them finance your innovation for you). Or go public and let outside investors finance billions of dollars in losses for you.

But that last one is probably not realistic. For the time being, at least.

-Tim