Numbers Tell Stories

At the risk of sounding like too much of a nerd, my favorite financial statement is the balance sheet. That’s because while the income statement and statement of cash flows are useful in showing what may have happened at a business during any given period, the balance sheet is what tells you how a business is positioned for what might happen next (which can also reveal a lot of context about what previously happened). And that’s interesting.

What’s further interesting, and what tells you a lot about the state of the business, is when you can discern whether or not that positioning was proactive i.e., it was something the operator of the business deliberately did or reactive, i.e., it was something the operator of the business had to do because of outside circumstances. Here’s an example…

We saw some numbers from a construction business recently that purported to have made about $3M on $20M of revenue over the past year. Not bad!

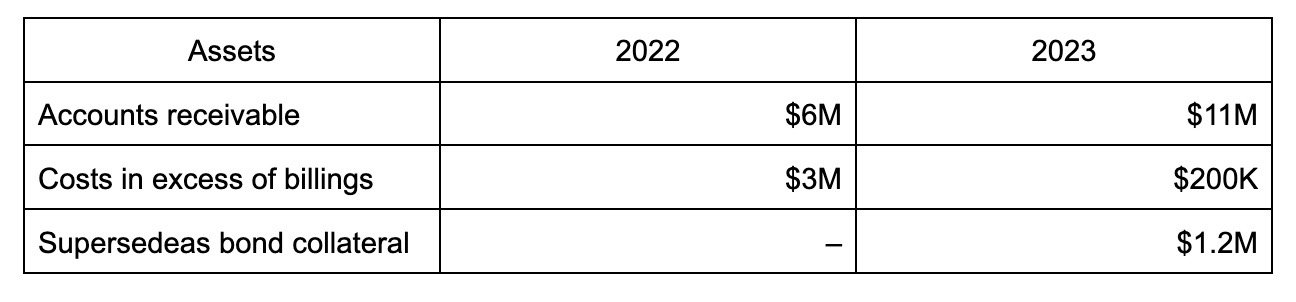

But the balance sheet told a different story. Here’s an excerpt from the asset side:

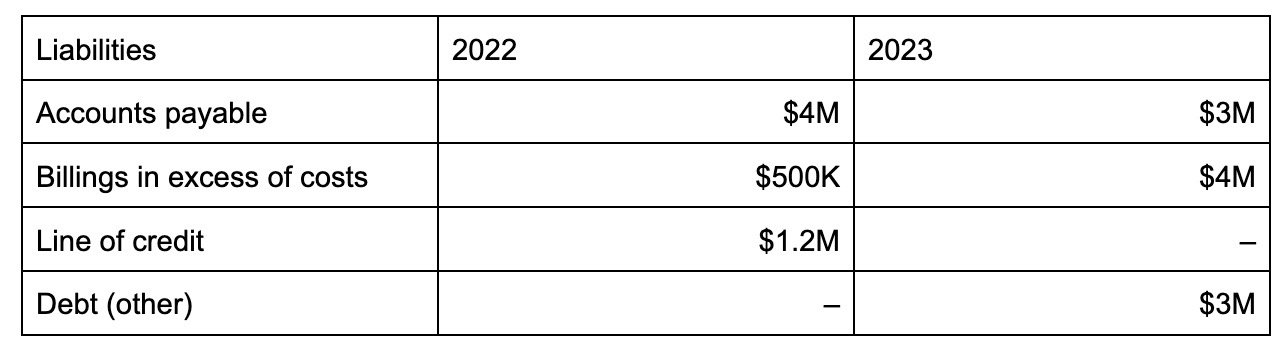

And the liabilities:

So despite “earning” $3M, here are some things that appear to be true based on how the construction business is currently positioned, as shown by its balance sheet:

Customers have stopped paying it in a timely manner (AR increase).

It’s gone from being underbilled to overbilled (i.e., it’s trying to get paid for work it hasn’t done yet).

It had to post more than $1M of collateral to its bonding company (presumably because there’s a job out there the bonding company doesn’t think the construction business has the ability to finish).

Its suppliers are demanding to be paid faster (AP decrease)

Its bank called in its line of credit (balance went to zero).

It replaced that low-cost, vanilla debt with millions of dollars of debt in the more ominous category of “other” (which probably carries a higher rate and is covenant heavy).

This, in other words, is a business that has lost agency and has been put in a position by its outside stakeholders to be on the verge of running out of money. If I had to guess what happened, the business had at least one or two major jobs turn bad, but hasn’t recognized those losses on its WIP report (shoutout Procore, it’s good software) yet. In other words, it’s either trying to hide them or is in denial. But, and this is important, the rumor mill most assuredly knows what’s up so people who owe the business money aren’t paying (because they know they may never have to) and the people the business owes money to are demanding to be paid now (in order to get as much out of it as possible before it goes under).

Not great!

Ultimately, business and investing are forward-looking enterprises and the only financial statement that can give you a clue about what’s to come is the balance sheet. Which is why it’s my favorite.

-Tim