2020 Election Expectations Survey

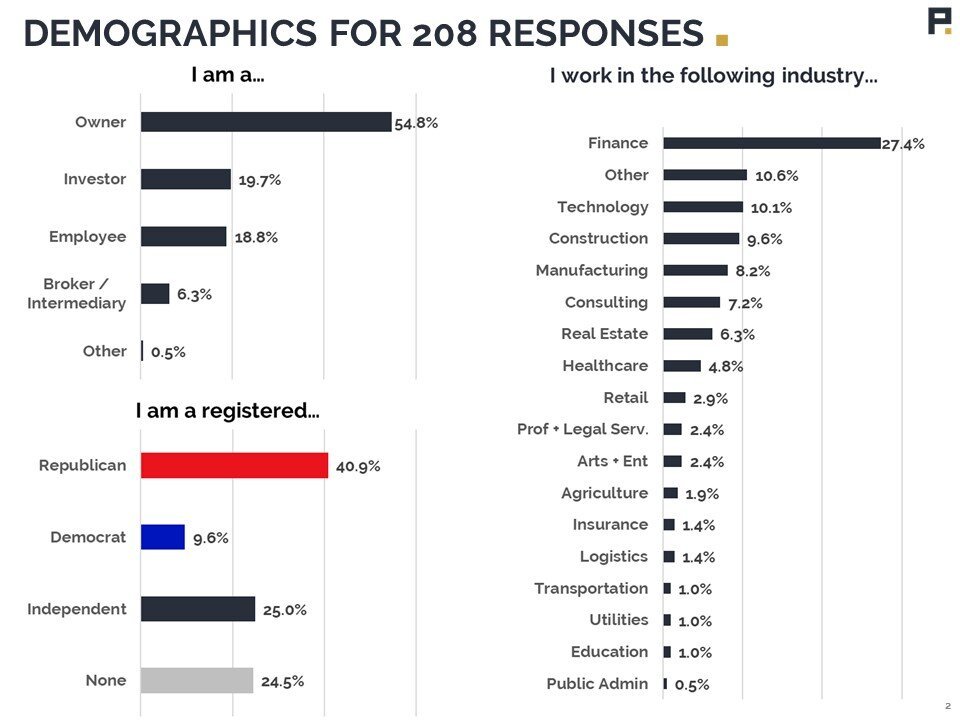

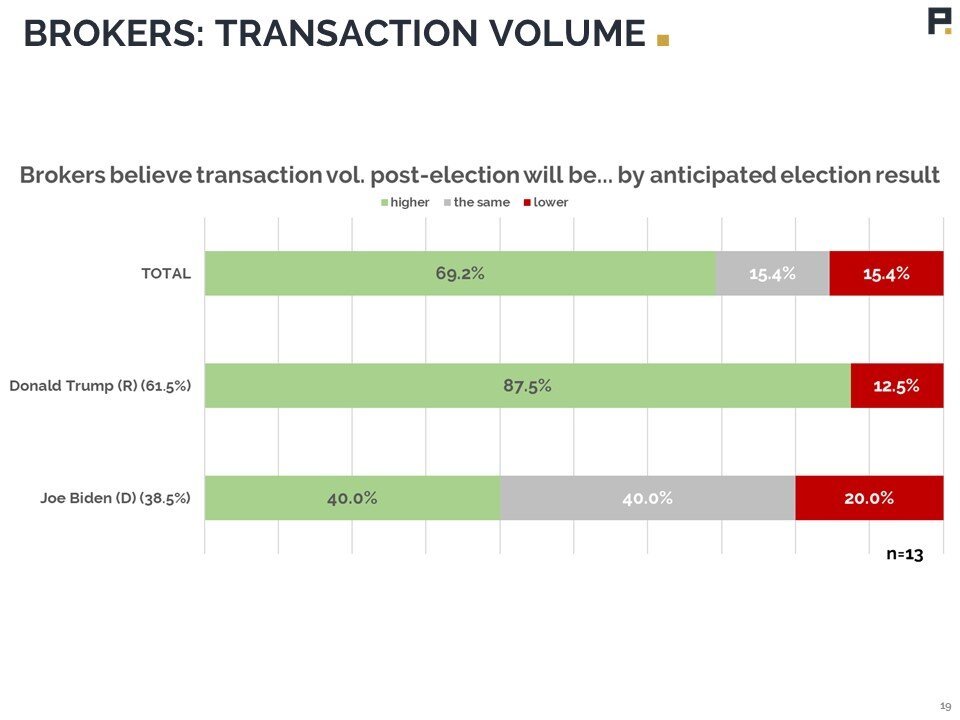

In our Weekly last Friday, October 23rd, we sent out an anonymous survey asking our readers to answer some questions regarding their expectations for the 2020 Elections and how their expectations impacted their views on the prospects for the economy, the stock market, and their own companies. 208 owners, investors, brokers, and employees responded, and the data reveals interesting connections between this demographic’s belief about election results and the anticipated impacts. Here is a brief writeup of our key findings.

Election Expectations

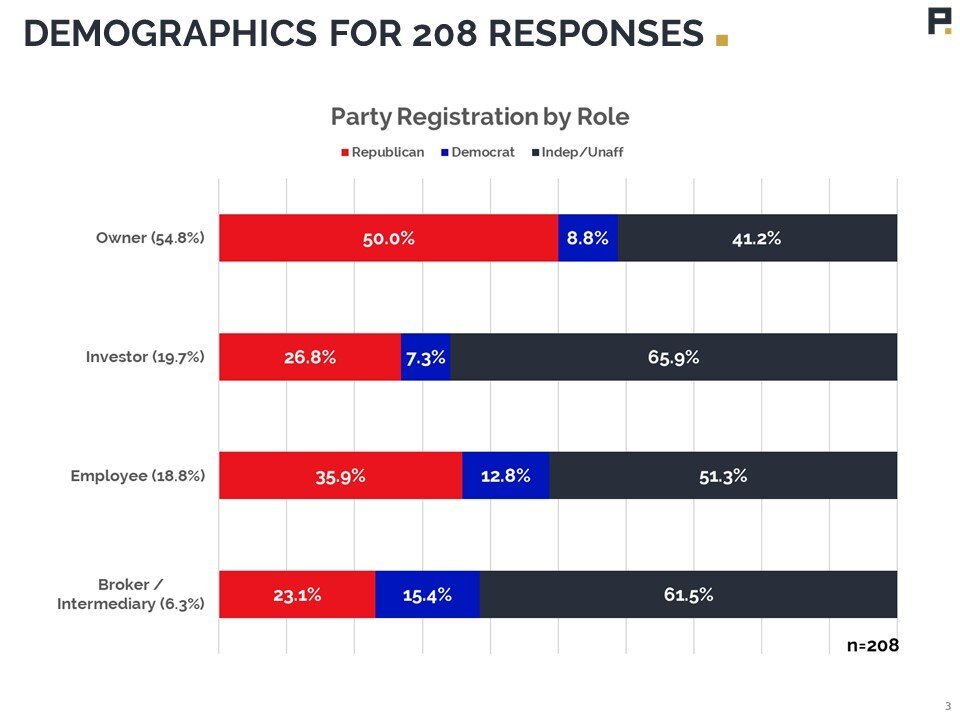

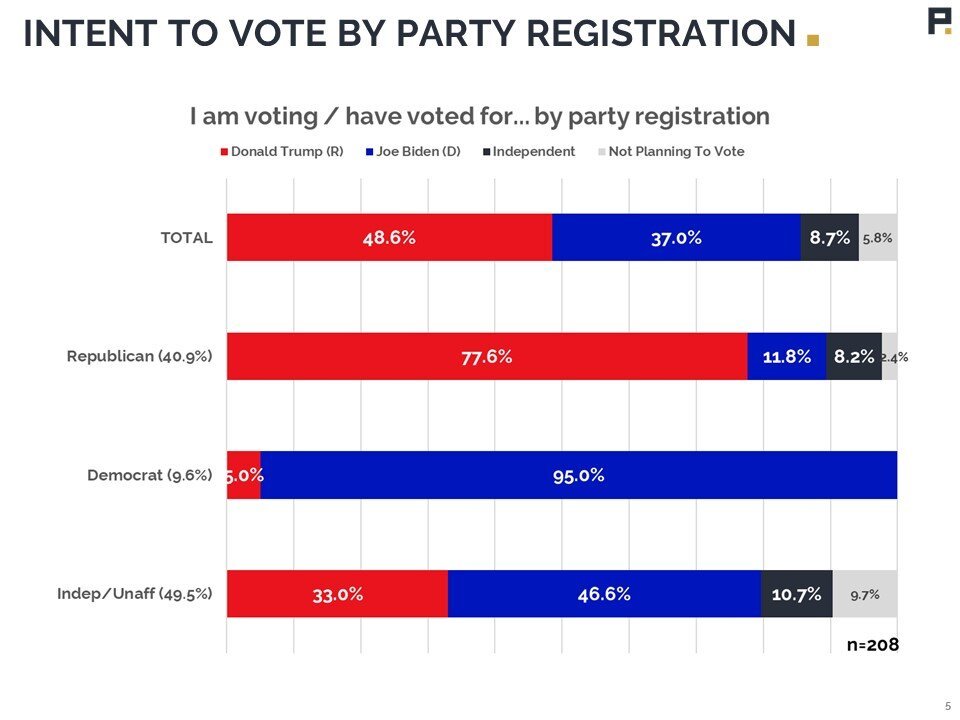

A full 50% of our respondents were political Independents or have no party affiliation. 40% are registered Republicans and 10% are registered Democrats. As expected, a majority of those surveyed intend to (or have already) voted for their party’s candidate. This affiliation is stronger for Democrats, with 95% reporting they intended to vote for Biden vs. 78% of Republicans planning to vote for Trump. Independents were 33% Trump, 47% Biden, and 20% Independent/Not Voting.

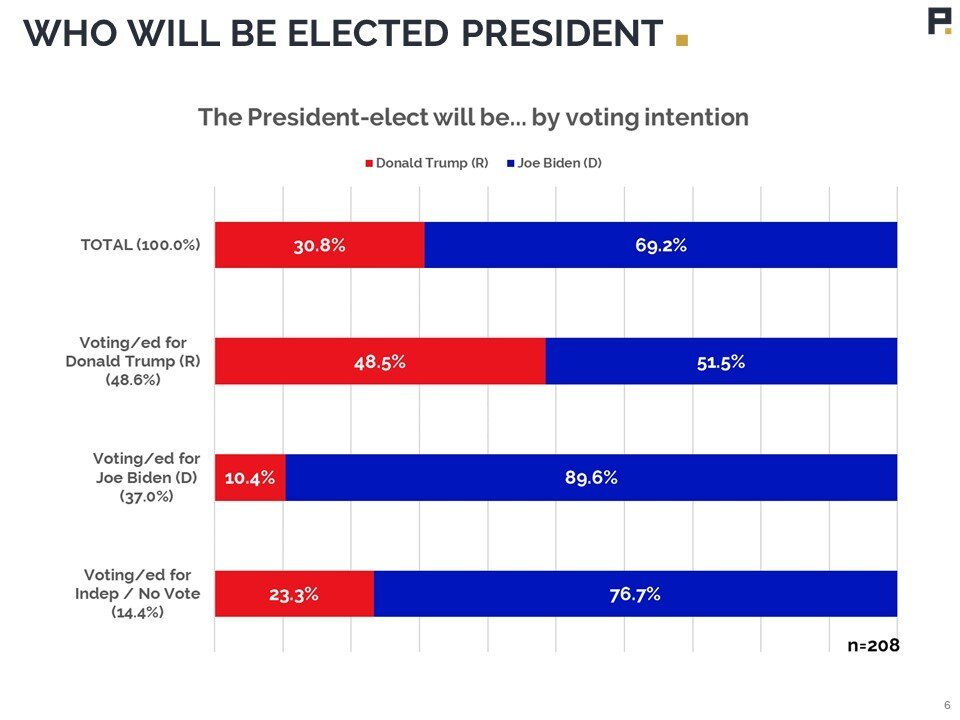

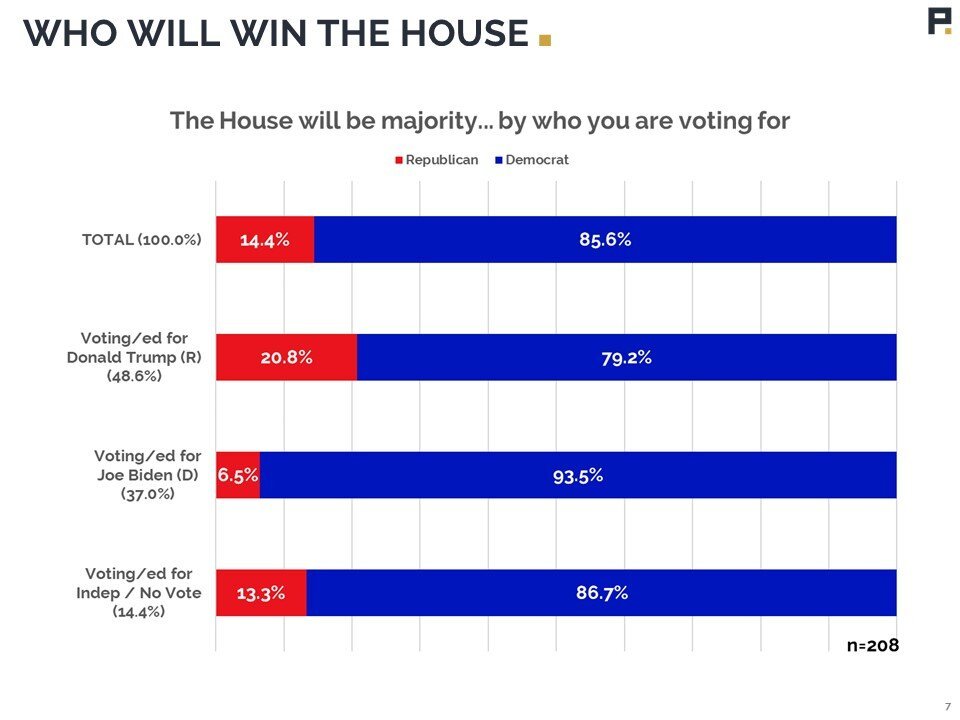

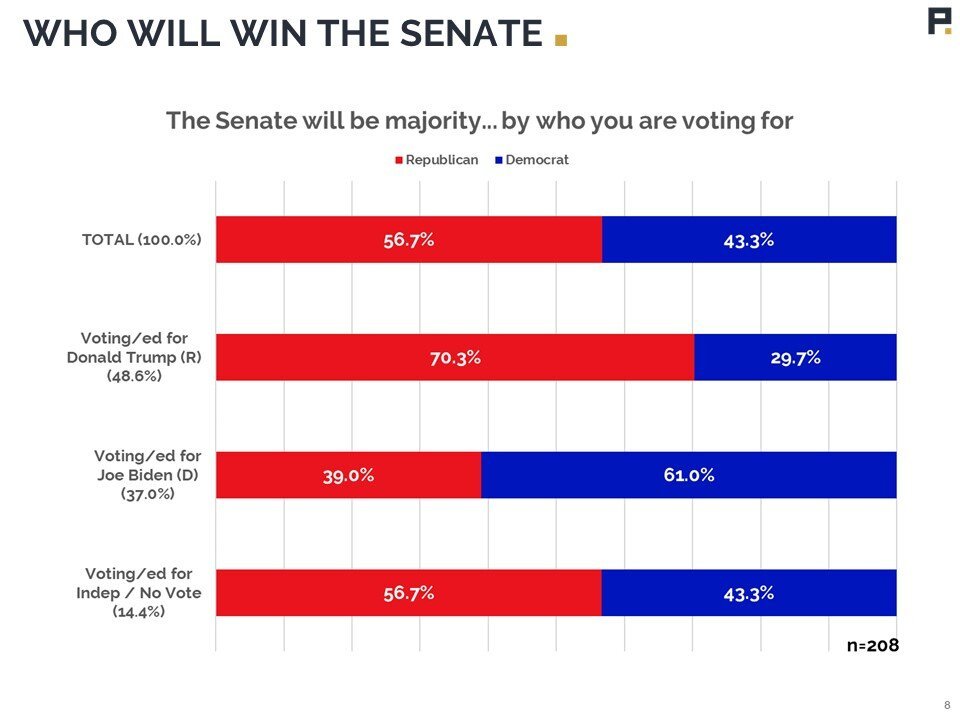

Regardless of who they intended to vote for, a majority in each group of voting intent believes that Biden will emerge as President-elect, with 52% of Trump voters thinking Biden will win, 90% of Biden voters, and 77% of Independent voters (69% overall). A vast majority of all respondents agree that the House will remain in Democratic hands (86%), but Senate results vary. 70% of Trump voters believe Republicans will hold the Senate and that number falls to 39% for Biden voters. 57% of Independents/NonVoters believe the Senate will remain Republican.

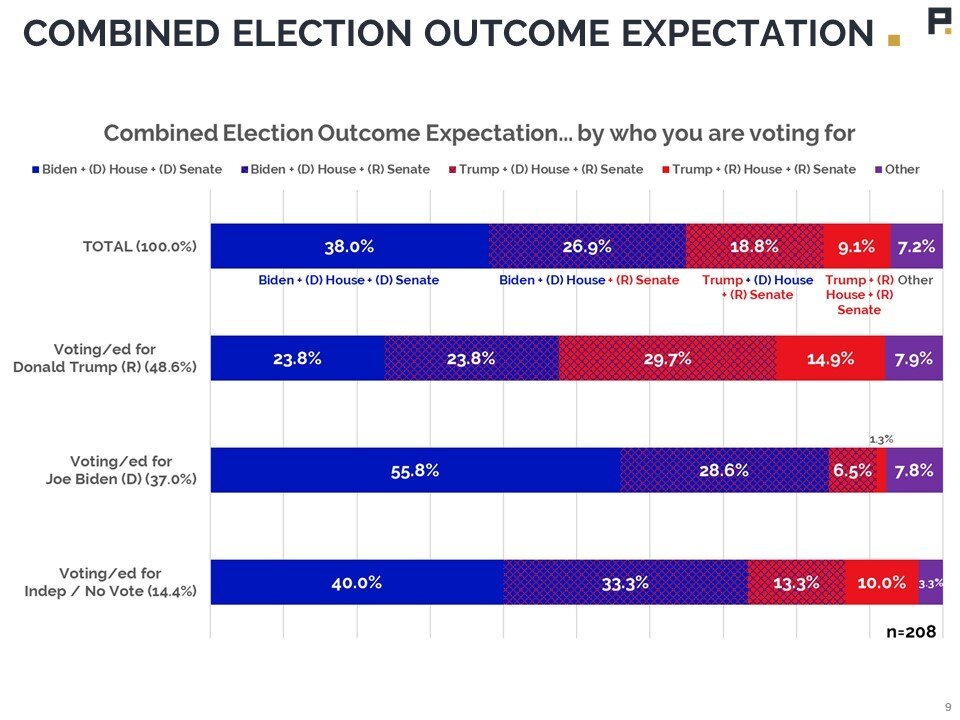

Aggregating these responses, 38% of those polled believe Biden will be elected with a unified government, with Democrats winning both the Senate and the House. 27% believe Biden will be elected with a Democrat-controlled House and a Republican-controlled Senate. 19% think Trump will win the presidency with a split House and Senate. 9% believe Trump wins with a unified government. You can see how these numbers break down by voting intent in the slide deck.

Election Implications

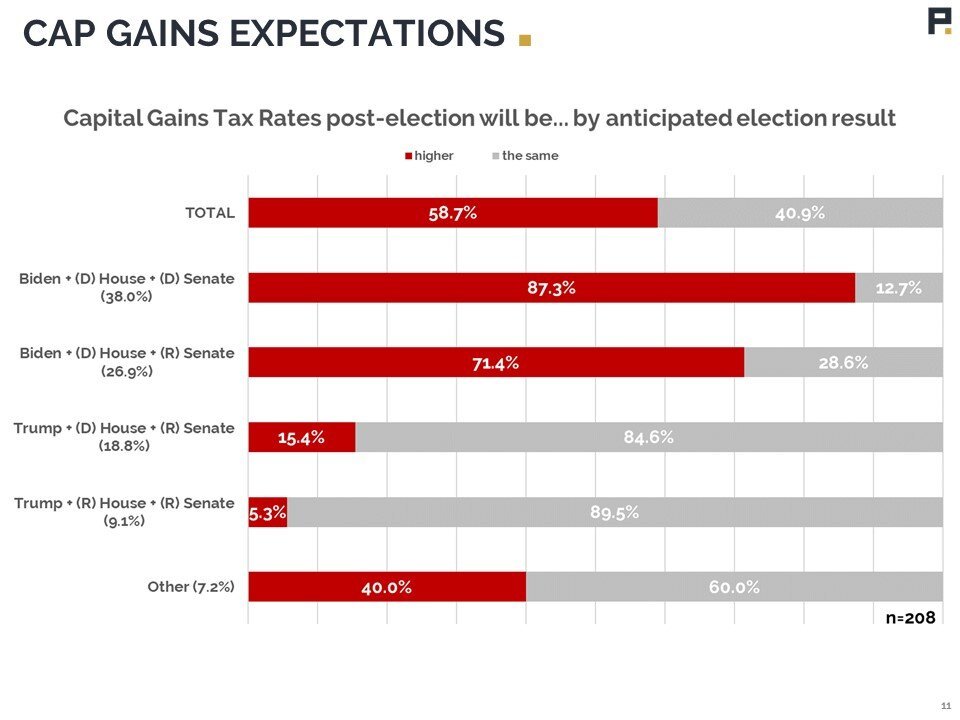

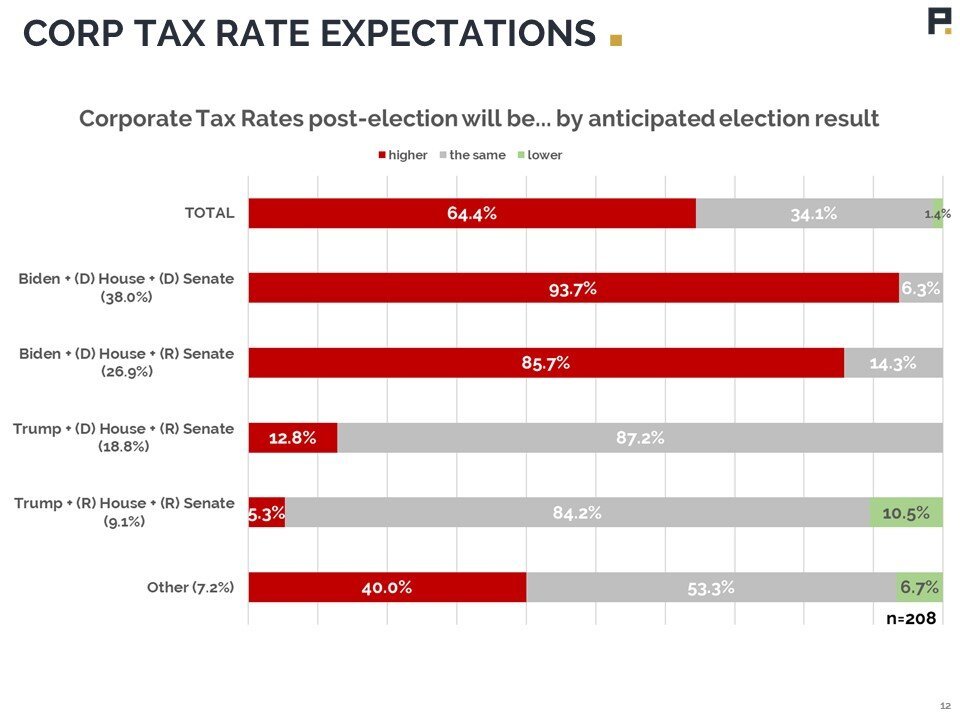

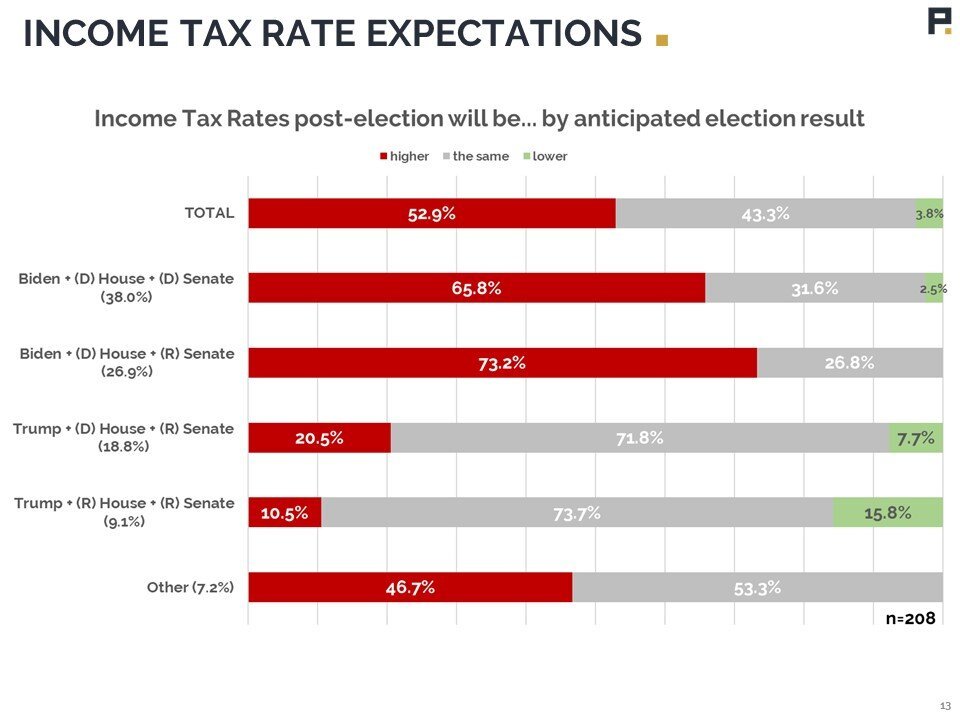

Respondents’ convictions on the downstream impacts of the 2020 election depended heavily on their anticipated result. Asked about the impact on Capital Gains tax rates, 87% of respondents who believe Biden will win with a unified government believe cap gains rates are going higher, ranging down to 5% of respondents who believe Trump will win with a unified government. Corporate Tax rate implications showed a similar range, with 94% anticipating higher corporate taxes under a unified Biden government vs. 5% anticipating higher rates under a unified Trump government. Income Tax expectations show similar disparities.

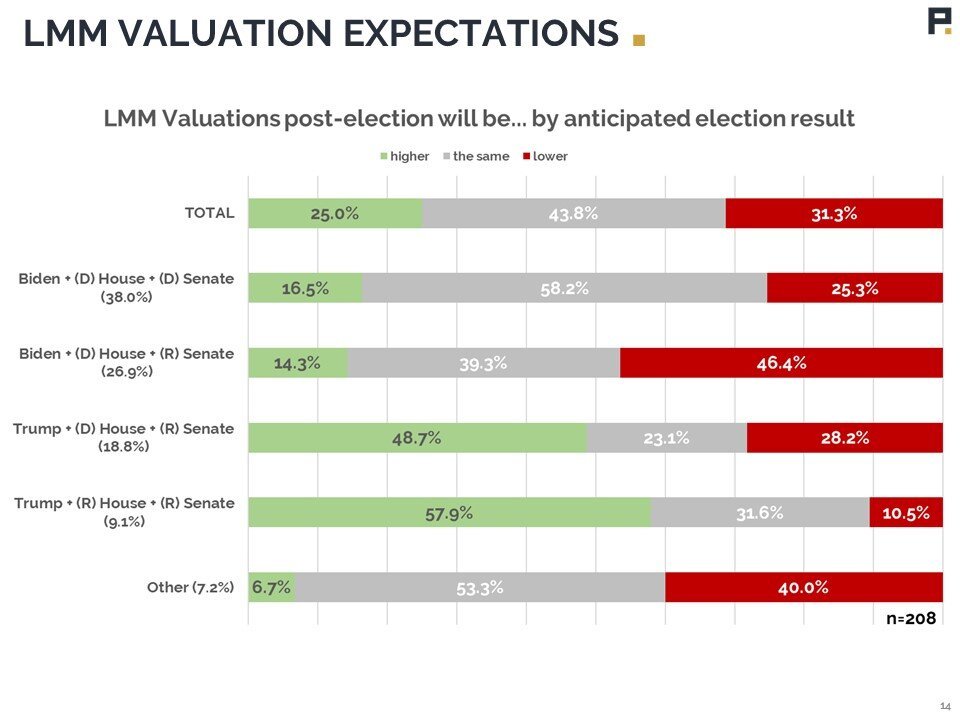

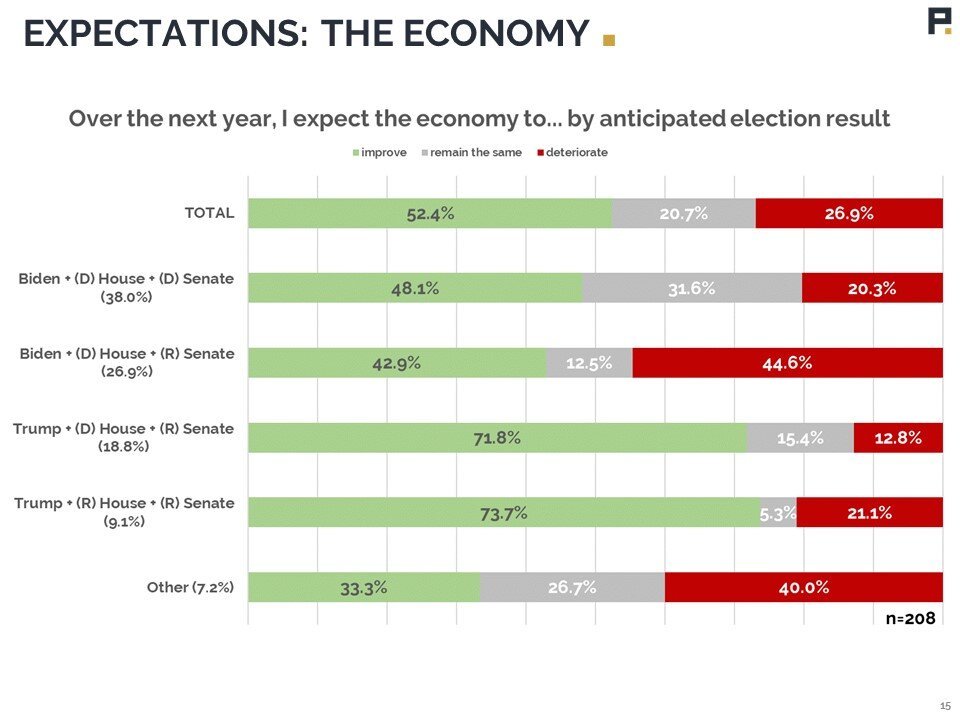

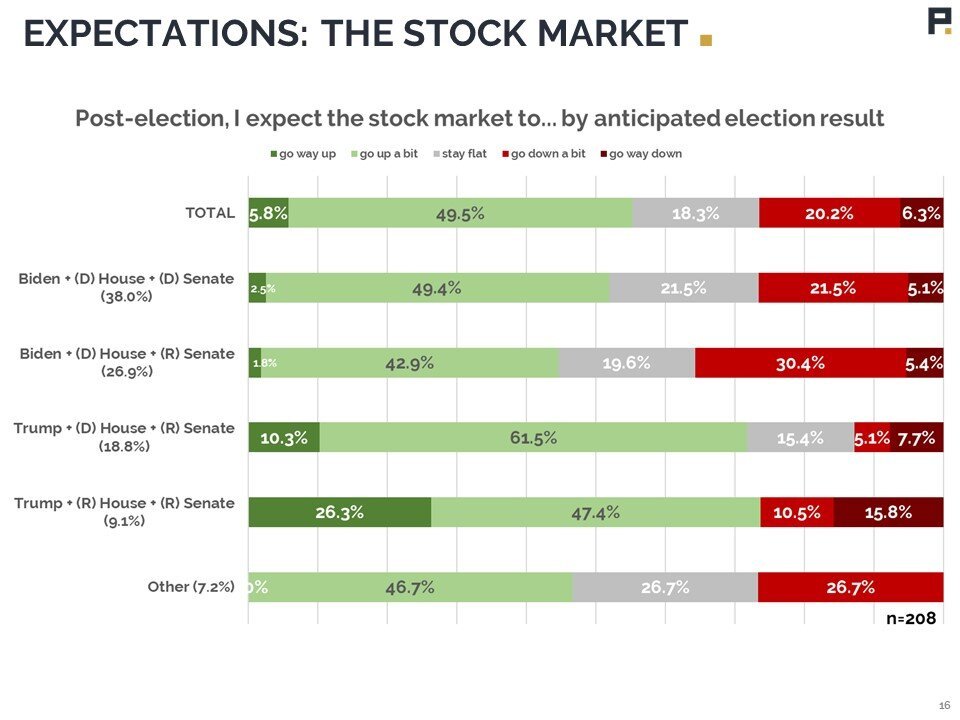

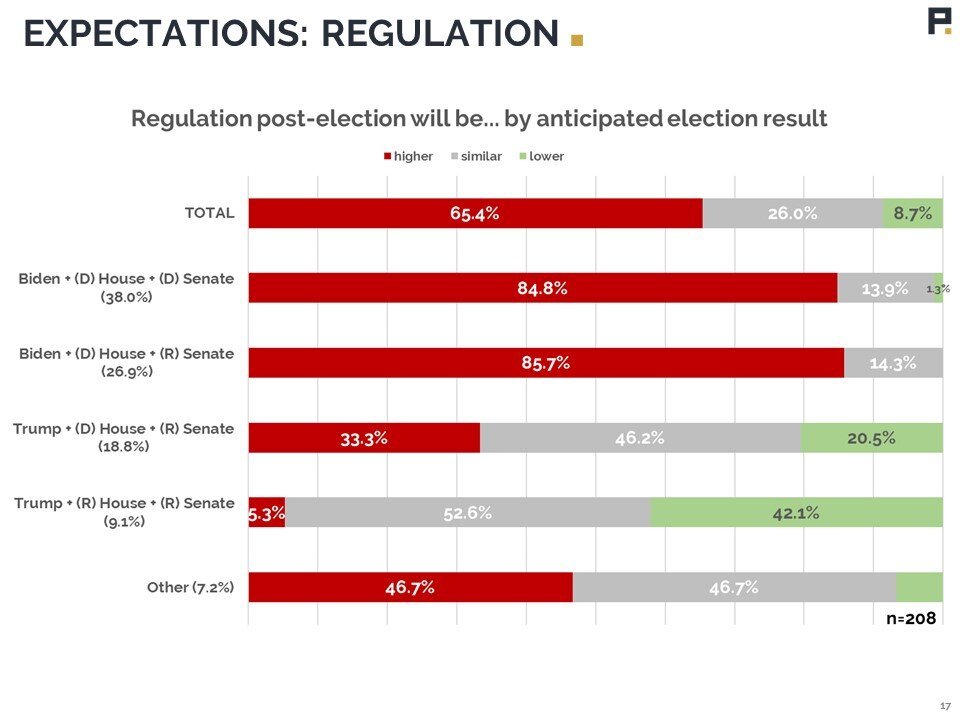

These gaps in expectations are similar for Lower Middle Market (LMM) valuations post-election. Only 17% of those who foresee a united Biden government believe LMM valuations will increase, while 58% anticipating a united Trump government think valuations will rise. Gaps like these persist for expectations around the broader economy, the stock market, and the regulatory environment post-election.

Election Hesitations

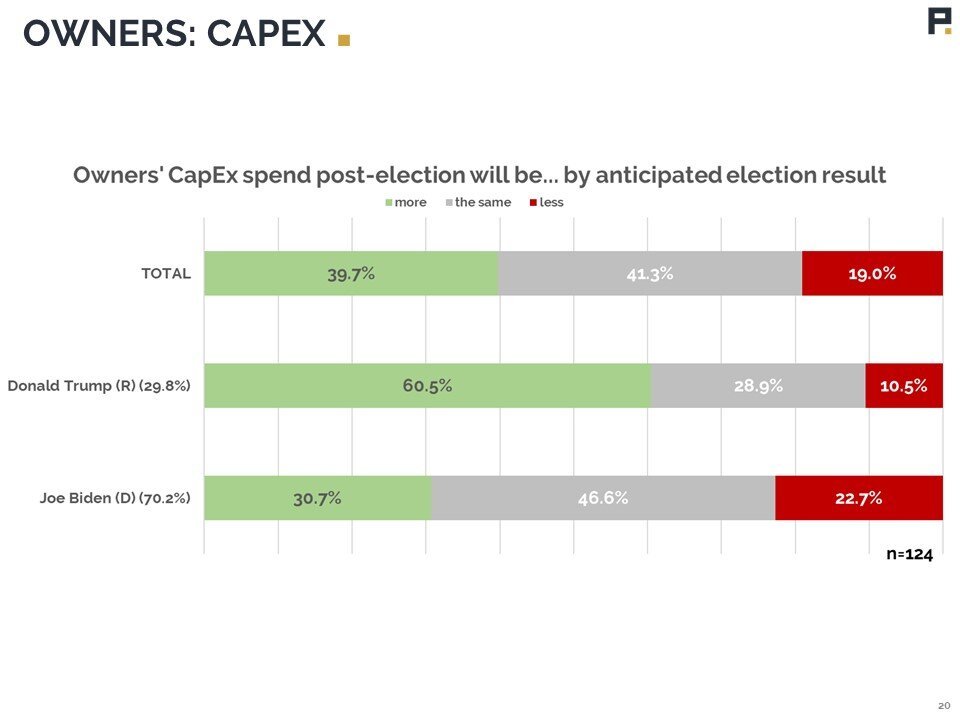

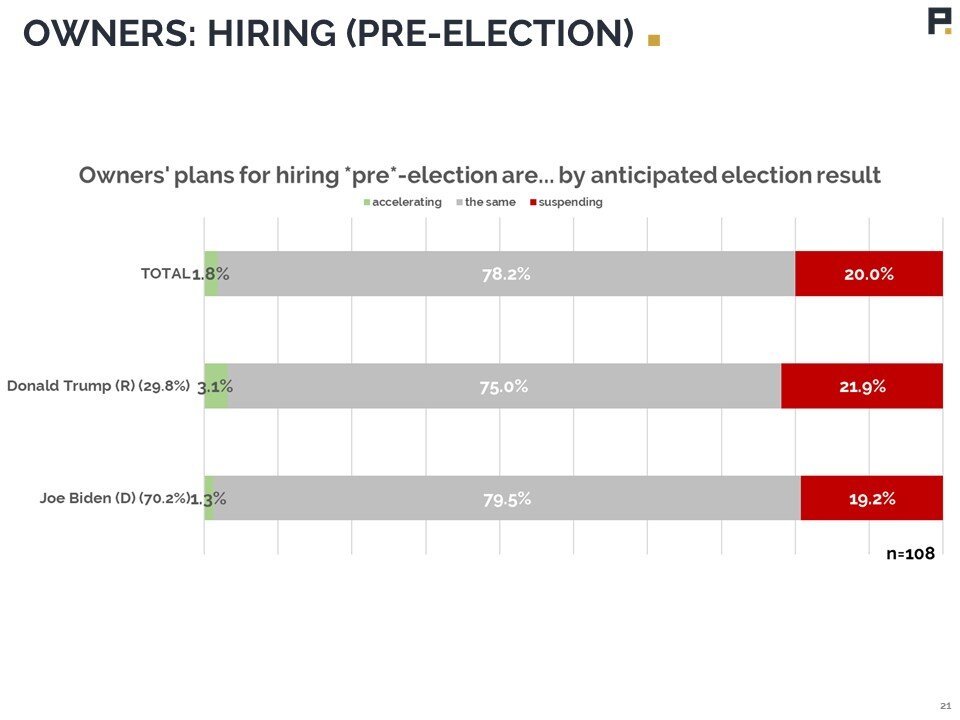

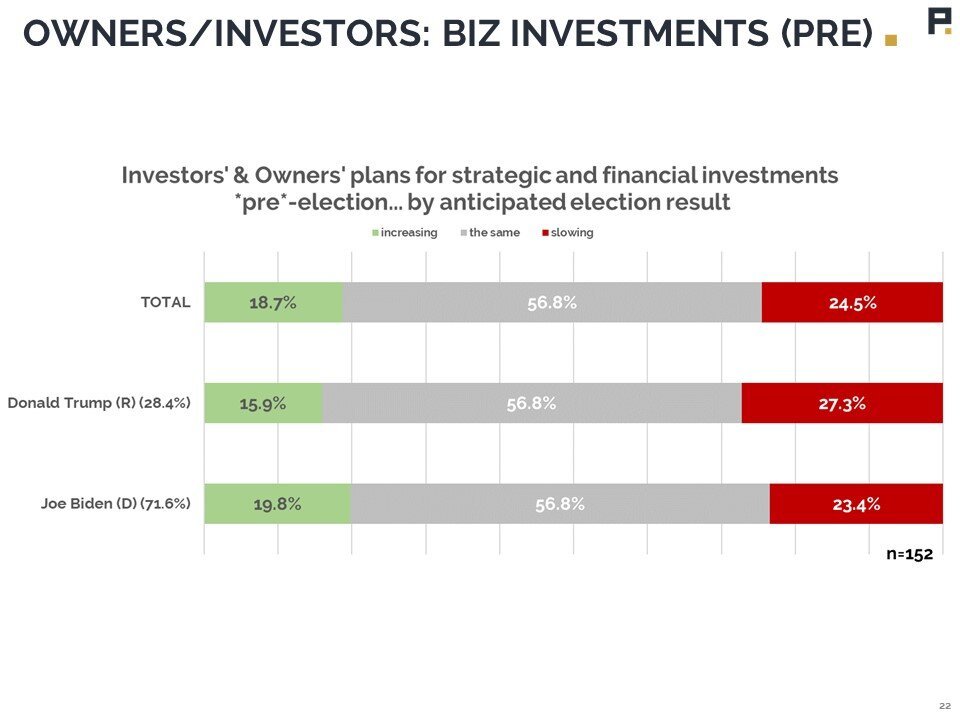

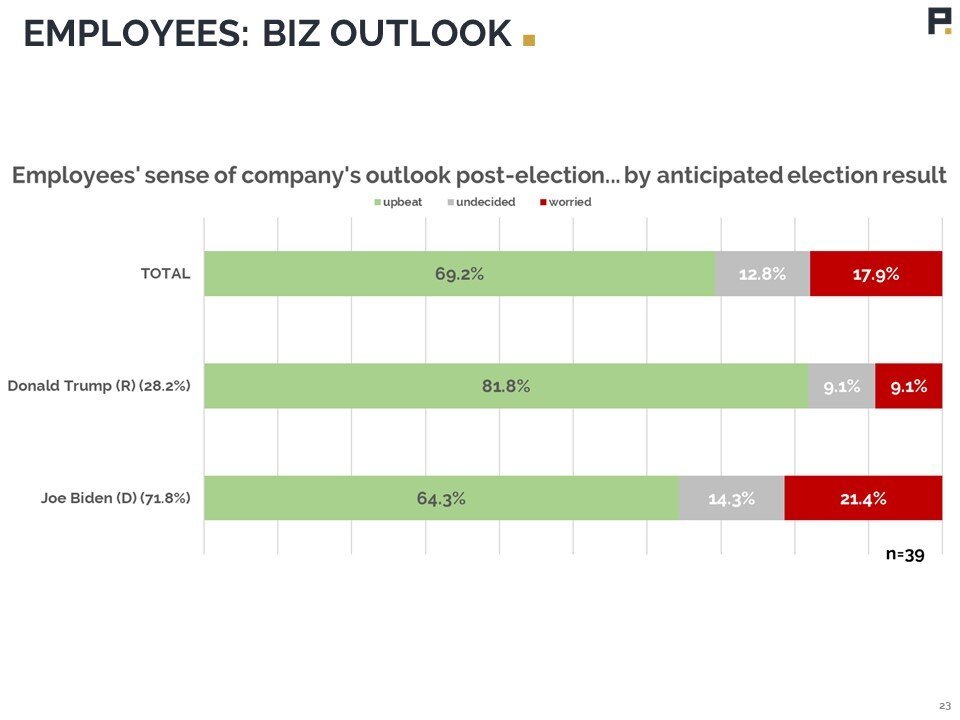

While predictions for the future state are wildly different depending on expected outcome, our respondents’ current actions are similar regardless of the election. 78% of all respondents are keeping their hiring plans steady, with little variance based on anticipated election outcome, and 57% are not altering the plans for financial or strategic investment in their companies with no variance based on anticipated election outcome. So while there are highly divergent post-election expectations, Owners and Investors seem to be waiting for the outcome before moving forward.

Final Thoughts

While voting preferences and expectations expressed in the survey are not outside what we’re seeing in other polling, the vast differences in beliefs about the future state of the economy, market, taxes, and governance are highlighted in the results. Regardless of your view of the potential outcome, we applaud owners and investors who are waiting to see the result before making moves regarding investing and hiring.