CEO Guide

Our CEO Guide is a shared playbook we circulate across our portfolio companies to align expectations, clarify decision-making and responsibilities, and outline operating rhythms. It’s meant to ensure that everyone involved knows what they own and how we’ll partner day to day.

This is the actual document we provide to our CEOs. It describes how we typically partner with management teams after closing. But it is illustrative, not prescriptive, because context always matters.

Decision-Making Authority

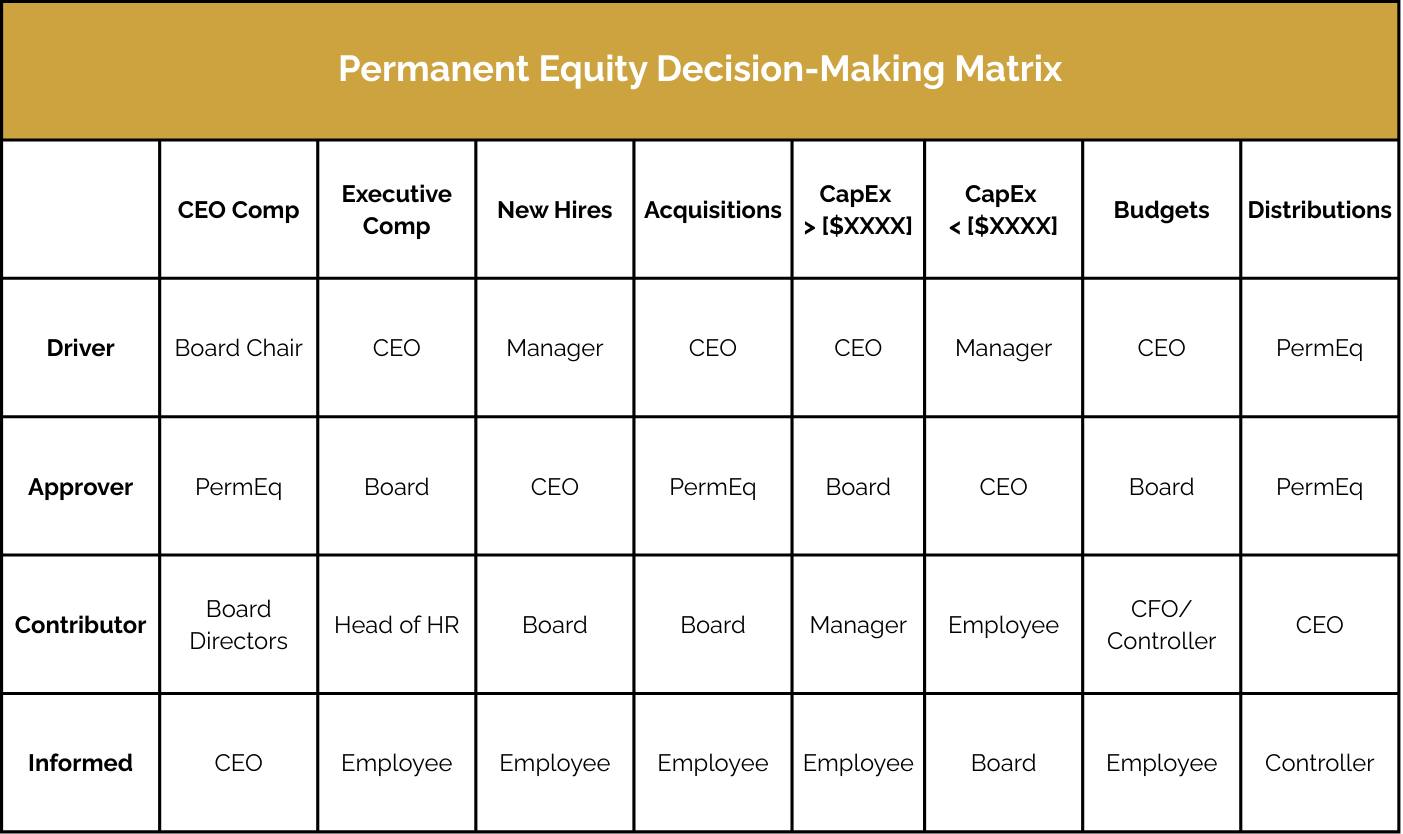

We believe it’s in your best interest and ours to give you as much autonomy as possible to run your company. We use a DACI model to lay out our decision-making framework across major categories. If you haven’t worked with it before, here are the role definitions:

Driver: People or stakeholders who do the work. They must complete the task or objective or make the decision. Several people can be jointly Drivers.

Approver: Person or stakeholder who is the "owner" of the work. He or she must sign off or approve when the task, objective or decision is complete. This person must make sure that responsibilities are assigned in the matrix for all related activities. Success requires that there is only one person Accountable, which means that "the buck stops there."

Contributor: People or stakeholders who need to give input before the work can be done and signed-off on. These people are "in the loop" and active participants.

Informed: People or stakeholders who need to be kept "in the picture." They need updates on progress or decisions, but they do not need to be formally consulted, nor do they contribute directly to the task or decision.

With those definitions established, here’s the DACI model for portfolio company decision-making:

Board vs. PermEq

You will notice that some roles are assigned to the board, while others are explicitly assigned to Permanent Equity as a firm. Your board is an advisory board, not a governing board. In practice, this means two things: we can avoid unnecessary formality in board format and there are certain decisions that are not fully at the discretion of the company’s board. Your board is responsible for operational oversight of the company, while the firm is accountable for investment returns and distributions to fund investors. The places where Permanent Equity appears in the DACI model have a direct or material impact on investment returns, and require the approval of the CIO in addition to the board.

Management Team Employment Decisions

The hiring and firing of members of the management team will follow our DACI structure with a slight tweak. As the Manager of a new leader, you as CEO will be the Driver and both you and the board will have Approver rights on the decision meaning either of us have veto power on the hire. We will not install someone onto your leadership team of whom you do not approve and we reserve the right to not hire someone we believe is not a good fit.

Exiting members of the management team is at your discretion, but the board may intervene if performance standards are not being met. Otherwise, you hold ultimate accountability for performance and the team it takes to achieve expectations.

Capital Expenditures

With rare exceptions, maintenance CapEx should be determined as part of the annual planning process. Because unplanned CapEx will impact Distribution calculations, please proactively communicate about items under consideration as soon as they are identified. While you are always welcome to talk with us about any expenditures, any capital outlay in excess of [$XXXXXX] will require explicit approval, whether planned or unplanned.

Not every decision is going to fit neatly into this framework, but we’ve found this covers 90%+ of choices that need to be made. Anything that falls outside of it typically requires a quick discussion on who owns what and how we want to proceed.

The Blueprint

The Blueprint is the organizing documentation of your company’s annual planning process, and reflects the performance expectations between Permanent Equity and your management team for the year. You are responsible for the initial draft, which will then be refined in collaboration with your board.

The Blueprint definitions are as follows:

Objective: Annual performance benchmark set forth by Permanent Equity’s Investment Council, generally tied to what makes the business model most valuable in its current form paired with what the company can improve

Strategies: 3 to 5 areas of focused planned improvement

Action Plans: Specific projects to be undertaken to achieve each strategy, including an accountable Owner, Timeline, and associated Metric(s)

Owner: Accountable party

Timeline: Deadline

Metric: How progress will be measured. When possible, this should be a quantitative measurement, but qualitative progress may be applicable for certain Action Plans.

The process begins each fall. In August/September, Permanent Equity’s Investment Council, led by the CIO, will set forth an annual one-line expectation for your company that is typically anchored in the business model’s current value drivers and improving quantitative performance over time. If you or the board feel strongly that the objective merits further discussion or refinement, your board chair should initiate that discussion. Otherwise, your role as CEO is to lead the drafting of strategies and action plans that will accomplish that objective.

Blueprints are typically drafted in September/October, and your board should plan to meet during that time. It’s at your discretion as to whether to meet in advance of or to review a Blueprint draft.

The final Blueprint draft should be submitted to the Investment Council by the Board Chair by mid-November. During this time, your budget should also be in development. The budget pairs with the Blueprint, and your Blueprint should be approved before the budget. Permanent Equity expects the budget to line up with performance expectations in the Blueprint.

A strong Blueprint will:

Feature strategies that meaningfully strengthen the business (and, where applicable, resolve weaknesses)

Include individual action plan owners who will be held accountable for the outcomes (not teams)

Fully reconcile with the budget

List quantifiable metrics that can be tracked monthly to assess progress

Be practical, not aspirational

Operationally, if financial projections or other Blueprint metrics begin to slip during the year, it is your responsibility to communicate and to also lead efforts on course corrections.

The Permanent Equity Financial Team will circulate monthly updates on the Blueprint.

Your Leadership Team

Expectations

When Permanent Equity invests in a company, we are investing because of what’s working, and that includes the team. That means that, unless required due to circumstances beyond our control, we’re not making big shifts in leadership upon investment. Rather, we want to support and preserve what’s working -- culture, institutional knowledge, relationships, and values. Over time (and especially as you grow), most roles change in scope and new ones are created, regardless of whether you have an investment partner or not. So, over time, it’s likely that your leadership team will be a blend of old and new.

Regardless, expectations for the people on your leadership team should move steadily upwards as we professionalize the organization. Some members of your team will be able to keep up and will perform admirably as the performance of the company grows. In other cases, the company will outgrow the capabilities of certain members of the management team. If a leadership role is outpacing someone’s capabilities, we expect you to work with the board on reassigning responsibilities or finding new talent. We count on you to continuously assess your team in the business’ best interest.

Strong management teams will be evident in the Blueprint based on diversified ownership of strategies and outcomes.

How We Work With Leadership Teams

In a well-oiled company there is a high level of trust between you and the members of your leadership team to execute their role. In an ideal situation, this includes interfacing with Permanent Equity on issues that are pertinent, but perhaps not strategic enough to warrant being filtered through you. These types of issues are typically in the areas of finance and accounting.

The Permanent Equity Finance Team will work day-to-day with your CFO/controllers on reporting and accounting quirks so that you don’t have to get bogged down in the weeds. We’ll always loop you in on any significant findings or concerns. As CEO, you are welcome to initiate or partake in financial reviews as often as you see fit, but there are a number of issues these two groups need to sync on regularly that do not justify your involvement.

Direct engagement with non-financial members of your leadership team will typically come in the form of special projects that we both agree are a priority for your company. Some past examples include working with your Tech leader to stand up a new website or working with your Marketing leader to create a lead scoring model. If there’s an initiative where our expertise can help (technology, marketing, etc.), we’re happy to dive in – but only if you agree it’s a priority and want our input. Final decisions will always rest with you and, if hefty enough, your board.

Acquisition Opportunities

Permanent Equity invested in your company’s business model because of its strengths, and so any acquisition pursuit must not distract from or erode those strengths. M&A can be alluring, and buying vs. building is common in traditional private equity, expediting growth. But, unlike Permanent Equity, most private equity firms intend to sell a company before materially managing post-close integration issues. Acquisition discussions will be focused on why it makes sense financially and operationally.

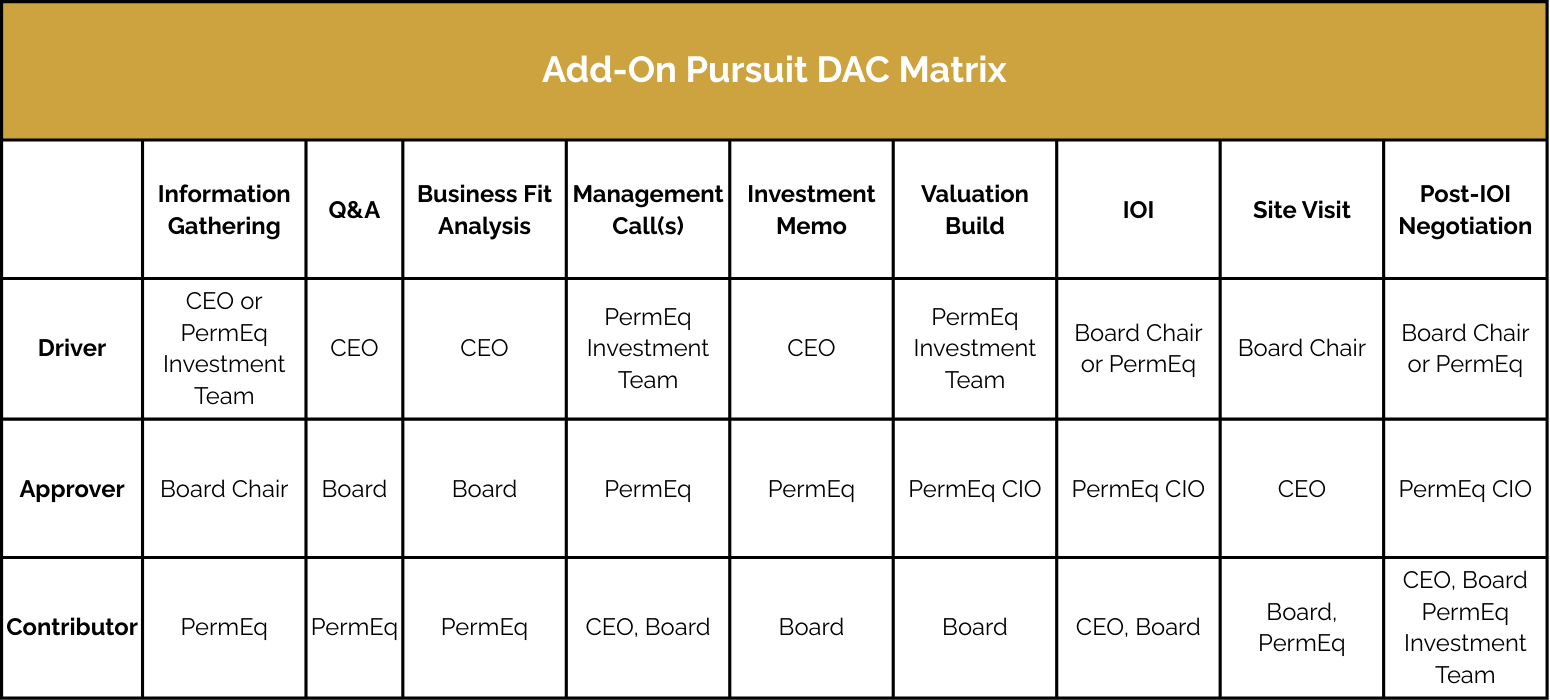

As you develop add-on ideas, socialize them with your board. Any acquisition (no matter how small) will require approval from Permanent Equity both as an investing concept and at each major milestone.

For any acquisition concept, you are encouraged to develop a strategy document, outlining what you are looking for, why, any known targets, along with what you are not interested in. This can be shared with the Permanent Equity Investment Team so that they can scout for opportunities alongside you.

In order for your company to initiate add-on activities, the following must be true:

Stable and predictable core business

Timely and accurate financials

Manageable integration

Leadership at your company that is expected to remain in place for a multi-year period, and is able to carry out a successful integration

Clear source of funds

Comfort with additional exposure

To initiate discussion on a specific opportunity, an Investment Memo must be drafted. As outlined in the DACI below, as CEO, you are the primary Driver (and therefore drafter) of that memo. The memo should answer the following questions:

What exactly are we buying? (This is typically a mix of earnings, talent/capabilities/capacity, relationships/market share/brand, and hard assets.)

Why are we buying it (vs. building it)?

How do we plan to integrate? Who will lead integration?

What are our expectations post-close?

What are the risks? What are the opportunities? What could prove complicated? Based on what we know now, what’s unknown or unclear?

These questions need to be answered before we can contemplate price or terms.

Add-on valuations are highly dependent on both historical performance and how your company intends to use the acquisition. Valuation will be correlated with the quality, size, and execution risk and opportunity, including the source of funds.

All add-on valuations, with the exception of asset only purchases within your company’s capital expenditures budget, will originate from the Permanent Equity Investment Team. Using numbers, even ballpark figures, in advance of underwriting may unintentionally kill a deal and is strongly discouraged.

There are many steps to underwriting an investment. Below is the DACI framework specific to add-ons, though some steps can be conditional based on a preapproved proactive add-on strategy.

Selling the Company

As implied by our name, Permanent Equity invests with no intention of selling. But that is not the same as saying we will never sell a company. In fact, there can be highly compelling reasons to sell. Our model enables us to have high opportunity costs as selling is not our sole way of generating returns for investors.

If someone contacts you about investing in the company, please notify your Board Chair. Whether or not we pursue a discussion, such outreach is helpful market intelligence to track.

We are most likely to proactively sell a company if either our existing thesis breaks or the company will benefit from a different ownership structure in pursuit of your next goal. Either way, if we start to explore that path, as CEO, you will be aware.

Any discussion about a potential sale of the company is strictly confidential, and should be limited to the board and Permanent Equity until a late stage. Rumors easily catch fire, and there’s no upside to the anxiety of unconfirmed change.

Common Values

Assume the Best: Unless there is a strong reason to believe otherwise, we’re going to assume that you are doing the absolute best you can at your job and that you are operating in good faith to steward the company to long-term success. And unless there is a strong reason to believe otherwise, please assume the same of the Permanent Equity team.

You are always going to know more about the inner workings of your company than we are. That’s as it should be, and that’s why you’re in the position that you’re in. Remember that we are on your side and we are cheering for your success. As we come alongside you and work to be a valuable resource, we will mess up. We will ask stupid questions, we will suggest things that aren’t feasible, we will misunderstand financials. Please give us the benefit of Hanlon’s Razor: “Never attribute to malice that which is adequately explained by stupidity.”

Mutual Respect: You are the CEO of this company because we respect your talent and your history of success. You’re here because we want to work with you. It is also our sincere hope that you don’t view this role as you having “arrived” or “peaked” or that you’re done growing. We want this to be the most fruitful personal growth experience of your career, so it’s our expectation that you will be open to both praise and constructive feedback, and pursue continuous improvement.

The Permanent Equity team is composed of former founders and operators who have been in trenches similar to yours, but not exactly the same. We will not be perfect partners, but we do have valuable experience that we hope to share. We’re also not done learning. Each portfolio company has presented us with challenges that we haven’t tackled before and your company will not be an exception. We pledge to be open to your feedback as well and commit to being a better partner over time

Transparency: We believe that in any high-performing organization, good news needs to travel fast and bad news needs to travel faster. We often say that the biggest mistake you can make is not the mistake itself, but not communicating it quickly enough. Bubbling up issues, errors, and challenges rapidly increases our options for how to address it. The further down the tracks we get, the fewer our options are. Please consider this the “No Surprises” rule.

As operators, when we’ve identified a misstep, our first thought is often, “I need to fix this before I talk about it,” or “I need to collect more information before I communicate this.” We understand both of these temptations but we prefer to know as soon as the smoke appears. This means if we’re tracking behind budget or a key Blueprint metric, you let us know as soon as you see the trend – no waiting until the quarter’s end. It gives us the option of bringing more resources to bear to help you with discovery and repair.

This type of rapid transparency applies to our operating relationship with you as the CEO as well. We will do our best to provide real-time feedback to you if we feel something is suboptimal with our relationship and we ask that you do the same. When we let things fester, walls go up, trust goes down, and progress gets tough.

Reliability: We work hard to do what we say we’re going to do when we say we were going to do it, and we prefer to work with people who follow this same ethic. We recognize that circumstances change and when they do, our strong preference is to have a prompt up-front discussion about how expectations need to shift rather than get to the finish line and be disappointed.

Your time is valuable to you and to us, so we will make every effort not to waste it. We’ll be on-time for meetings and phone calls, and we’ll be apologetic when we fall short. When we promise we’ll deliver something to you on a timeline, we’ll do it. If we don’t, call us out. Being reliable is a great hallmark of mutual respect.

If Someone Wrongs Us

Humans are inherently messy. It’s likely that you are going to have disagreements with members of your team, customers, partners, or suppliers. And it’s not unrealistic to think that a member of one of those stakeholders will maliciously attempt to harm you, us, your business, a partner of your business, or people on your team.

As a firm, we’ve been through a number of these scenarios. Our policy with bad-faith actors is two-fold. First, we never attempt to retaliate in any way, in writing, verbally, or through our actions towards them. Everyone, including those acting in bad faith, acts in what they believe to be a rational way at the time. Second, we are not a doormat. While we seek to achieve a swift and amiable resolution, we don’t shy away from defending ourselves against malicious actors.

As with any issue, if you become aware that someone within or adjacent to your company is seeking to wrong the collective “us,” we trust you will alert us as soon as you become aware without trying to “solve” the solution first (see our section on Transparency). Depending on the situation, our desire will be to remove you from the resolution process as quickly as possible to allow you to focus on operating the business. Our legal team will take point as rapidly as they can and keep you informed of their progress as warranted.

Work Style and Communication

Being an experienced operator, it’s likely that you have a preference for how you like to work. Early or late. Text or voice. Zoom or email. Each of us on the Permanent Equity team has our own style as well and we have no desire to make you conform to any particular work schedule or rhythm.

As your board forms, discuss the optimal cadence and format(s) for communication. We recommend that you are on a “live” channel with each other at least once per month. Some operators have also found circulating written reports to be helpful. The Permanent Equity Financial Team will circulate your Blueprint updates and metrics monthly as well.

In good times, a monthly call may be plenty; if the company is facing headwinds or underperforming, let’s talk as often as needed – even weekly – to ensure we’re aligned and supporting you.

Your Board Chair serves as the primary point of contact on operations, while the Permanent Equity Finance Team will regularly check in with you and members of your team to collect and share data.

The full board typically meets 2 to 3 times per year, but should convene virtually or in person for:

Annual Blueprint Planning & Budget Approvals (and longer term strategic planning)

Major Capital Commitments/Opportunities: M&A, capital expenditures, facility expansion

Strategic Shift: new market, product development, channel pivot, competitor movement, etc.

Leadership Transition: surprise vacancy, performance concern, planned succession

Performance Concerns: significantly off budget, cash conversion, safety, customer churn, etc.

Travel Expectations

Even in a world of dramatically improved video conferencing technology, we’re still believers in the power of meeting face-to-face with someone and sharing a cup of coffee, a glass of wine, or a meal. We trust you to make good decisions about when you need to travel to visit customers and partners and when things can be handled via video or phone.

We don’t do per diems and we don’t have a firm-level policy on travel expenses, so it’s helpful to lay out basic expectations. When you’re on the road, we want you to be safe and comfortable and those you’re visiting to be well cared for. If you need to pay extra to not sit in a middle seat or next to the lavatory on a flight, do it. If a flight with a much better itinerary for your life schedule is going to cost an extra couple hundred bucks, book the better itinerary.

We don’t expect you to sleep in motels and we don’t expect you to choose the Ritz. We don’t expect you to eat at McDonald’s (unless you’re into that sort of thing) and we don’t expect you to blow it out at The Palm every night. If you’re entertaining, you know your customers best. Choose a restaurant that is going to make them feel valued and make sure everyone has a good meal with good drinks. We trust you to make good choices.

Overall, make sure your travel and entertainment spending is reasonable relative to the business, and that your budget reflects your plans. If something unusual comes up, just give us a heads up.

Succession Planning

Permanent Equity requires all boards to review succession plans at least annually. Typically, boards keep three forms of these plans: the emergency plan, the development plan, and the strategic runway for the decade ahead.

Emergency Plan: Who would step in tomorrow if something unexpected happens?

Development Plan: What roles are ready for bigger challenges, and what leaders need further development to prepare for what’s next?

Strategic Runway: What leadership team will the company need in the coming years? What new roles may be required as we grow?

Obviously, your personal runway is a major contributing factor, as are those of your management team. We appreciate that signaling anything other than full long-term commitment comes with career risk, but please know that we consider awareness and time to collaboratively execute a plan highly valuable and a mark of strong stewardship. If a member of the management team signals reduced long-term commitment, performance changes, or unexpected health or family changes, flag it quickly.

Succession readiness is part of performance management. Our collective goal should be for the company to outlast your involvement as well as ours. We expect you to allocate real time and resources to developing your next generation of leaders.

If something about your runway changes outside of annual planning, please proactively communicate with your board chair.

Beer Money

Our fund model provides optionality in how Permanent Equity generates returns, but we are indeed expected to generate returns. You will likely hear us reference “Beer Money” when discussing performance expectations. Beer Money is the money, all accounting shenanigans and GAAP adjustments aside, that you have leftover at the end of the day that you can withdraw from a bank account to buy beer with. Permanent Equity aims to generate Beer Money for our investors.

Distribution estimates will be generated based on your annual budget and mutually agreed upon minimum cash levels. Where you have high conviction, high return opportunities to reinvest in building the company, those should be the top priority and reflected in the Blueprint. That said, we want to use lower cost than retained earnings sources of capital when we can (e.g. lines of credit or vehicle or equipment financing) in order to make regular distributions of generated profits .

By regularly distributing cash flows, we avoid the pressure of needing to sell a company to generate returns. At the fund level, distributions are made to investors in January and July of each year, but the CEO should be in discussion with his or her board about when to make distributions within those 6-month windows.

This document is provided solely for general informational purposes and is intended to offer insight into certain philosophies, principles, and ways Permanent Equity often partners with the management teams of its portfolio companies after an investment has been made. It is illustrative in nature only and does not describe a required, uniform, or exhaustive set of practices. The content is not intended to be, and should not be construed as, legal, tax, accounting, investment, or other professional advice, nor as creating, modifying, or implying any legal rights, obligations, fiduciary duties, or standards of conduct.

This document does not constitute, and should not be construed as, an offer to sell, a solicitation of an offer to buy, or a recommendation with respect to any securities, investment vehicles, or advisory services. Any such offer or solicitation will be made only pursuant to definitive offering documents and governing agreements, which will contain material information, risk factors, and binding contractual terms that may differ materially from the general concepts described herein.

The governance practices, decision making frameworks, expectations, and examples described in this document are intended to be illustrative of how Permanent Equity may work with certain portfolio companies in certain circumstances. Actual practices vary based on the specific facts, negotiated agreements, regulatory considerations, industry dynamics, and stage of the business, and may change over time. No representation is made that any of the approaches described will apply to any particular company, management team, transaction, or situation, and no reliance should be placed on this document as a substitute for negotiated contractual arrangements or individualized advice.

Nothing in this document should be interpreted as a commitment, promise, guarantee, or assurance regarding autonomy, governance rights, performance outcomes, distributions, returns, or operational results. Past experience and illustrative examples are not indicative of future results.

Readers should consult their own legal, tax, financial, and other professional advisors regarding the applicability of any concepts described herein to their specific circumstances.

Permanent Equity does not undertake any obligation to update or revise this material, and it may be modified or withdrawn at any time without notice.